News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin’s post-quantum plan BIP-360 gains traction, but will it reverse market sell-off?2Bitcoin holders are being tested as inflation fades: Pompliano3 Bitcoin Price Bottom Not In Yet? Data Signals More Pain Ahead

Tether Expands Global Payment Reach – USDT on Stable Debuts via Oobit Integration

BlockchainReporter·2026/02/17 06:00

Bullish Comments from Bitwise CIO – “If the Bill Passes, These Two Altcoins Will Break Records”

BitcoinSistemi·2026/02/17 05:48

Bittensor (TAO) Price Surges—How Long Will the $200 Mark Remain Out of Reach?

Coinpedia·2026/02/17 05:30

Crypto extreme fear suggests incoming inflection point: Matrixport

Cointelegraph·2026/02/17 05:18

Galxe (GAL) Migrates to GravityChain (G): What It Means for Crypto Traders and GAL Holders

BlockchainReporter·2026/02/17 05:00

Bitcoin’s long-term investors display signs of pressure following the February sell-off

101 finance·2026/02/17 04:39

Bitcoin Soars: BTC’s Triumphant Rally Surges Past $69,000 Milestone

Bitcoinworld·2026/02/17 04:21

CZ FUD Opportunity: Timeless Wisdom Reveals How Savvy Crypto Investors Thrive Amid Market Chaos

Bitcoinworld·2026/02/17 04:21

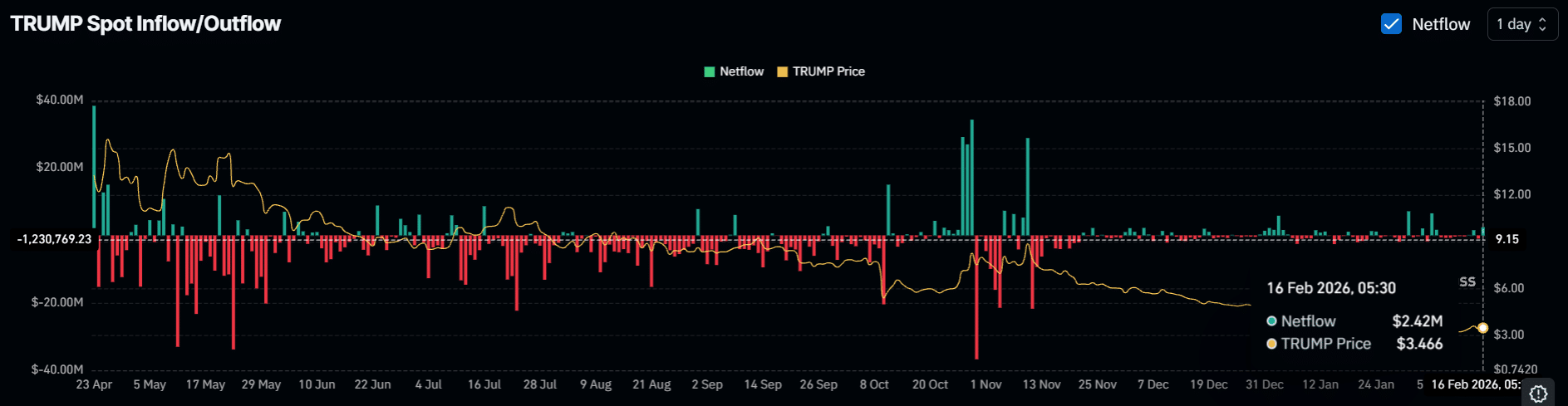

6.33 mln TRUMP tokens set to unlock: Will this lead to a 12% drop?

AMBCrypto·2026/02/17 04:03

Flash

05:50

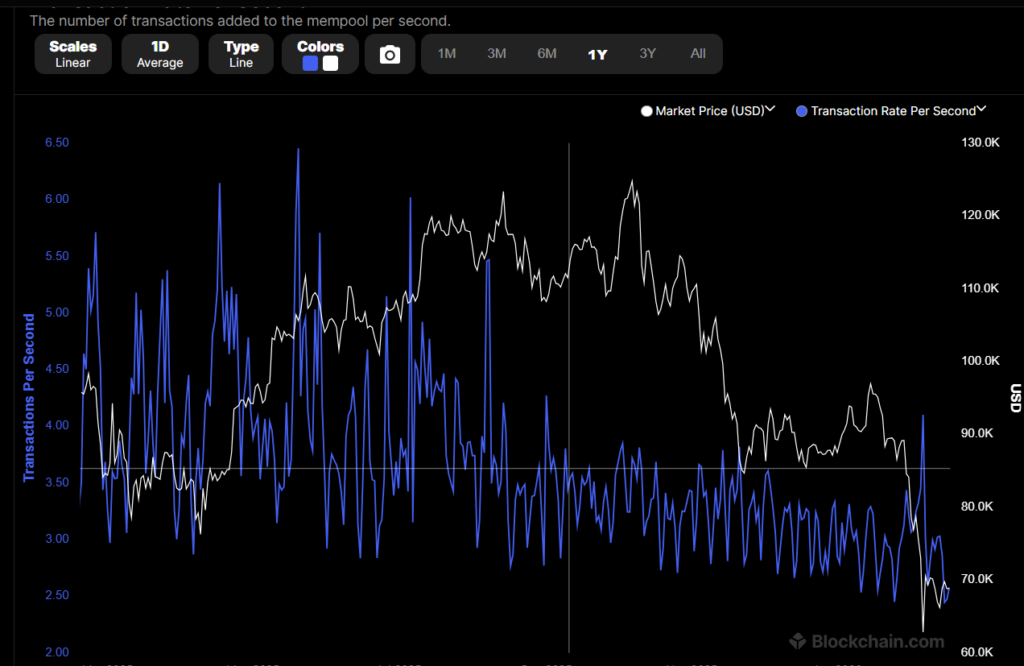

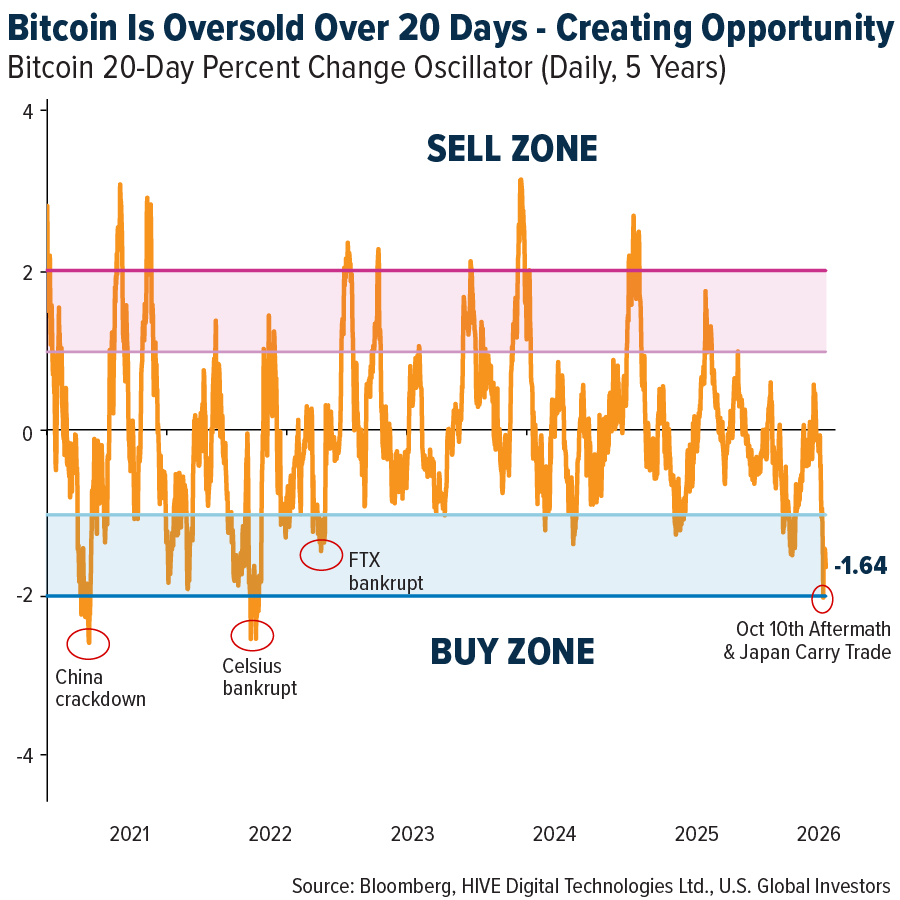

Analysis: Extreme Market Panic May Signal an Approaching Turning PointBlockBeats News, February 17, according to Cointelegraph, the current crypto market sentiment has dropped to an "extremely depressed" level, possibly approaching the formation of a "persistent bottom," with selling pressure potentially gradually exhausting. The Bitcoin "Fear and Greed Index" shows that when the 21-day moving average falls below the zero axis and then turns upward again, it often corresponds to a stage bottom, and a similar signal has now appeared. This usually indicates that selling momentum is weakening and market conditions are beginning to stabilize. However, the institution also reminds that prices may still dip further in the short term, but historical experience suggests that periods of extreme negative sentiment often provide relatively attractive entry opportunities. Meanwhile, the "Fear and Greed Index" compiled by Alternative.me reads 10 (out of 100), in the "extreme fear" range, the lowest since June 2022. Hive Chairman Frank Holmes stated that Bitcoin's current price is about two standard deviations below its 20-day average, a situation that has only occurred three times in the past five years. Historical data shows that in similar extremely oversold environments, a technical rebound is more likely to occur within the following 20 trading days. If Bitcoin closes lower in February, it will mark the fifth consecutive month of decline, one of the longest losing streaks since 2018. The market is watching whether extreme sentiment and technical oversold signals will jointly drive the formation of a new turning point.

05:40

Spot Gold Sell-Off Intensifies, Down 2.60% Intraday, Extends Losses to Test $4860/oz DownsideBlockBeats News, February 17th, according to Bitget market data, spot gold extended its decline, reaching down to $4860 per ounce, down 2.60% intraday.

New York spot gold plummeted by 3.00% intraday, now trading at $4886.00 per ounce; New York spot silver plunged by 7.00% intraday, now trading at $72.51 per ounce.

05:32

Odaily Noon News1. Philippine digital bank Maya is exploring an IPO in the United States; 2. Data: Over $2 billions in ETH short positions are accumulating above $2,200; 3. Harvard University reduced its BTC holdings by 20% in Q4 and added $86 millions in ETH positions; 4. Matrixport: Market sentiment has dropped to a low level, and short-term prices may still weaken further; 5. Bitdeer sold 179.9 BTC last week, with its Bitcoin holdings falling below the 1,000 mark; 6. The Hong Kong Securities and Futures Commission has added Victory Fintech to its list of licensed entities, marking the first new virtual asset trading platform since June last year; 7. Bitcoin's weekly RSI is approaching the bear market lows of 2022, with liquidity squeeze intensifying the battle between bulls and bears; 8. Machi Big Brother sold some altcoins to go long again on BTC, ETH, and HYPE.

News