Bitget: Ranked top 4 in global daily trading volume!

BTC dominance57.86%

Current ETH GAS: 0.1-1 gwei

Hot BTC ETF: IBIT

Bitcoin Rainbow Chart : Accumulate

Bitcoin halving: 4th in 2024, 5th in 2028

BTC/USDT$66611.60 (-2.47%)Fear and Greed Index13(Extreme fear)

Altcoin season index:0(Bitcoin season)

Total spot Bitcoin ETF netflow +$254.4M (1D); +$603.9M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app.Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC dominance57.86%

Current ETH GAS: 0.1-1 gwei

Hot BTC ETF: IBIT

Bitcoin Rainbow Chart : Accumulate

Bitcoin halving: 4th in 2024, 5th in 2028

BTC/USDT$66611.60 (-2.47%)Fear and Greed Index13(Extreme fear)

Altcoin season index:0(Bitcoin season)

Total spot Bitcoin ETF netflow +$254.4M (1D); +$603.9M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app.Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC dominance57.86%

Current ETH GAS: 0.1-1 gwei

Hot BTC ETF: IBIT

Bitcoin Rainbow Chart : Accumulate

Bitcoin halving: 4th in 2024, 5th in 2028

BTC/USDT$66611.60 (-2.47%)Fear and Greed Index13(Extreme fear)

Altcoin season index:0(Bitcoin season)

Total spot Bitcoin ETF netflow +$254.4M (1D); +$603.9M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app.Download now

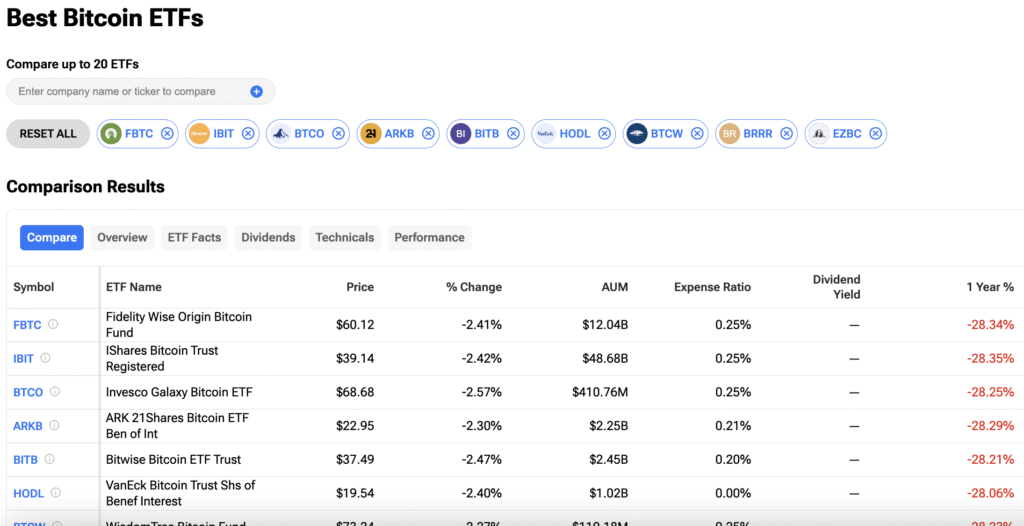

ARK 21Shares Bitcoin ETF

ARKB

Learn more about ARK 21Shares Bitcoin ETF's (ARKB) price performance, volume, premium rate, inflows and outflows, and other key data indicators.

ARKB price today and history

$22.38 -0.6 (-2.61%)

1D

7D

1Y

Open price$22.6

Day's high$22.66

Close price$22.33

Day's low$22.08

YTD % change-24.16%

52-week high$41.99

1-year % change-29.49%

52-week low$20.66

The latest price of ARKB is $22.38 , with a change of -2.61% in the last 24 hours. The 52-week high for ARKB is $41.99 , and the 52-week low is $20.66 .

Today's ARKB premium/discount to NAV

Shares outstanding109.25M ARKB

BTC holdings36.94K BTC

NAV per share$22.91

BTC change (1D)

+360.53 BTC(+0.99%)

Premium/Discount+0.27%

BTC change (7D)

+1.56K BTC(+4.4%)

ARKB volume

Volume (ARKB)6.32M (ARKB)

10-day average volume (ARKB)164.62K (ARKB)

Volume (USD)$141.37M

10-day average volume (USD)$3.68M

ARKB net flow

| Time (UTC) | Net flow (USD) | Net flow (BTC) |

|---|---|---|

2026-02-26 | -$44.9M | -665.7 BTC |

2026-02-25 | +$2.3M | +33.85 BTC |

2026-02-24 | +$71.1M | +1.11K BTC |

2026-02-23 | -$9.2M | -142.36 BTC |

2026-02-20 | $0.00 | 0.00 BTC |

2026-02-19 | $0.00 | 0.00 BTC |

2026-02-18 | $0.00 | 0.00 BTC |

2026-02-17 | -$8.3M | -123.01 BTC |

2026-02-13 | $0.00 | 0.00 BTC |

2026-02-12 | -$31.5M | -475.52 BTC |

2026-02-11~2024-01-11 | +$1.53B | +36.77K BTC |

Total | +$1.51B | +36.51K BTC |

What is ARK 21Shares Bitcoin ETF (ARKB)

Trading platform

BATS

Asset class

Spot

Assets under management

$2.51B

Expense ratio

0.21%

Issuer

21Shares US LLC

Fund family

21Shares

Inception date

2024-01-10

ETF homepage

ARKB homepage

Offering exposure to bitcoin (BTC), the ARK 21Shares Bitcoin ETF (ARKB) tracks the performance of bitcoin, the largest crypto asset by market cap. ARKB offers a way for investors to gain bitcoin exposure with the combined crypto expertise of ARK and 21Shares.

ARKB seeks to track the performance of bitcoin. The Fund maintains exposure to “spot” bitcoin.

FAQ

What is the minimum investment required for the ARK 21Shares Bitcoin ETF?

The minimum investment can vary based on the platform, but generally it is equivalent to the price of one share of the ETF, which can be purchased on Bitget Exchange.

Is the ARK 21Shares Bitcoin ETF available for trading 24/7?

While Bitcoin itself can be traded 24/7, the ARK 21Shares Bitcoin ETF trades during regular stock market hours unless otherwise specified by the platform, including Bitget Exchange.

How is the ARK 21Shares Bitcoin ETF tracked?

The ETF is designed to track the price performance of Bitcoin, with the goal of mirroring its market performance as closely as possible.

What are the fees associated with the ARK 21Shares Bitcoin ETF?

The fees typically include management fees, which can be found in the ETF's prospectus, and any trading fees present on the exchange where it's traded, like Bitget Exchange.

Can institutional investors access the ARK 21Shares Bitcoin ETF?

Yes, institutional investors can access the ETF through approved brokers and platforms, such as Bitget Exchange, making it easier for them to invest in Bitcoin.

Are there any risks associated with investing in the ARK 21Shares Bitcoin ETF?

Yes, like any investment, it carries risks, including market volatility, regulatory changes, and the performance of Bitcoin itself.

What advantages does the ARK 21Shares Bitcoin ETF offer?

The ETF provides regulatory protection for investors, simplifies the process of accessing Bitcoin, and has the potential for tax advantages compared to direct investments.

Where can I buy the ARK 21Shares Bitcoin ETF?

You can purchase the ARK 21Shares Bitcoin ETF on various exchanges including Bitget Exchange.

How does the ARK 21Shares Bitcoin ETF differ from buying Bitcoin directly?

Investing in the ARK 21Shares Bitcoin ETF allows investors to gain exposure to Bitcoin without needing to manage wallets or private keys. It also might provide easier access through traditional brokerage accounts.

What is the ARK 21Shares Bitcoin ETF?

The ARK 21Shares Bitcoin ETF is an exchange-traded fund that invests in Bitcoin, allowing investors to gain exposure to Bitcoin's performance through a regulated financial product.

ARK 21Shares Bitcoin ETF news

Bitcoin ETFs Record $616 Million in Back-to-Back Gains as Diamond Hand Holders Refuse to Sell

Tipranks2026-02-10

Harvard endowment tilts harder into Bitcoin ETFs than Google stock

Crypto.News2026-02-10

U.S. bitcoin ETFs see consecutive days of inflows for the first time in a month

101 finance2026-02-10

$BTC ETFs See Record Inflows; Is $HYPER the Next L2 Breakout?

Newsbtc2026-02-10

Matrixport: Bitcoin ETF Holdings Remain "Stubbornly Long," Market Deleveraging May Only Be Delayed

金色财经2026-02-10

Spot Bitcoin ETF Inflows Surge with $144.9 Million as Investor Confidence Rebounds

Bitcoinworld2026-02-10

Alternative ETFs

| Symbol/ETF name | Asset class | Volume (USD | Share) | Assets under management | Expense ratio |

|---|---|---|---|---|

IBIT iShares Bitcoin Trust | Spot Active | $1.98B 51.92M IBIT | $51.96B | 0.25% |

BITO ProShares Bitcoin ETF | Futures Active | $964.26M 103.75M BITO | $2.55B | -- |

FBTC Fidelity Wise Origin Bitcoin Fund | Spot Active | $351.87M 6M FBTC | $17.68B | 0.25% |

BTC Grayscale Bitcoin Mini Trust ETF | Spot Active | $255.48M 8.58M BTC | $4.34B | 0.15% |

GBTC Grayscale Bitcoin Trust ETF | Spot Active | $212.2M 4.04M GBTC | $10.58B | 1.5% |

BITB Bitwise Bitcoin ETF | Spot Active | $169.83M 4.64M BITB | $2.64B | 0.2% |

Prefer buying cryptocurrencies directly? You can trade all major cryptocurrencies on Bitget

Bitget—The world's leading crypto exchange

Looking to buy or sell cryptocurrencies like Bitcoin? Choose Bitget, the cryptocurrency exchange offering top-tier liquidity, an exceptional user experience, and unmatched security!

Bitget app

Trade anytime, anywhere with the Bitget app. Join over 30 million users trading and connecting on our platform.

Cryptocurrency investments, including buying Bitcoin online via Bitget, are subject to market risk. Bitget provides easy and convenient ways for you to buy Bitcoin, and we strive to fully inform our users about each cryptocurrency we offer on the exchange. However, we are not responsible for the results that may arise from your Bitcoin purchase. This page and any information included are not an endorsement of any particular cryptocurrency. Any price and other information on this page is collected from the public internet and cannot be considered as an offer from Bitget.