News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Macro headwinds test Bitcoin price as $70K crumbles amid US market volatility2Trump filling Democratic seats at SEC, CFTC could advance crypto bill talks, TD Cowen says3Bitcoin price ignores $168M Strategy buy, and falls as Iran tensions escalate

Ethereum Foundation Unveils Ambitious 2026 Protocol Roadmap: Scaling, Security, and Quantum Readiness

Bitcoinworld·2026/02/19 04:36

AI agents put to the test as crypto hacks hit $3.4 billion

Cryptopolitan·2026/02/19 04:21

South Korean National Pension Service Crypto Holdings Plunge 28% in Q4 2025 Amid Market Turmoil

Bitcoinworld·2026/02/19 04:21

Spot Ethereum ETF Outflows Spark Concern as BlackRock Leads $42.5 Million Withdrawal

Bitcoinworld·2026/02/19 04:21

Solana Sentiment Cools: Critical Analysis of Network Issues and Weak Technicals Impacting SOL

Bitcoinworld·2026/02/19 04:21

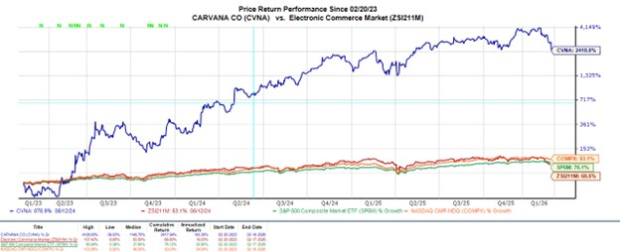

Is Carvana Stock a Buy After Crushing Q4 Expectations?

Finviz·2026/02/19 03:48

What kind of software will be eliminated by AI?

华尔街见闻·2026/02/19 03:35

Flash

04:51

Federal Reserve economists praise prediction markets as valuable forecasting toolsPANews, February 19—According to Decrypt, Federal Reserve researchers stated in a working paper that macroeconomics-focused prediction markets can provide policymakers with real-time, market-based measures of inflation and interest rate expectations. The research found that these models closely match or even outperform traditional benchmark forecasts, while also offering continuously updated probability distributions around key data releases and policy meetings. The authors pointed out that prediction markets can serve as a valuable supplement to existing forecasting tools in research and policy environments. By providing transparent, continuously updated, and economically interpretable expectation metrics, prediction markets can open new avenues for studying monetary policy transmission, market sentiment, and macroeconomic uncertainty. Meanwhile, state-level regulatory agencies are stepping up scrutiny of prediction markets. A ruling by the Ninth Circuit Court on Tuesday cleared the way for Nevada to pursue civil enforcement. A request to suspend Nevada’s enforcement actions against federally regulated prediction markets was denied, allowing the state to proceed while broader legal disputes continue. This decision has intensified the debate over whether such markets should fall under federal commodity law or state gambling regimes. According to informed sources, although the ruling allows Nevada to move forward with enforcement cases, it is only a temporary decision and does not address the substance of the appeal. If Supreme Court review is sought, it must occur after the full appeal is resolved in the Ninth Circuit. Currently, federal regulators have previously challenged the scope of certain event contracts, and several states believe some prediction markets resemble unlicensed gambling operations, having issued cease-and-desist orders and initiated enforcement lawsuits.

04:47

The White House plans to hold the third stablecoin revenue meeting tomorrow.PANews reported on February 19 that, according to crypto journalist Eleanor Terrett's post on X, the White House plans to hold the third stablecoin yield meeting at 9:00 a.m. Eastern Time tomorrow (10:00 p.m. Beijing time). A small group of representatives from the cryptocurrency and banking sectors are expected to attend.

04:46

Federal Reserve Research: Kalshi May Become a Superior Tool for Measuring Macroeconomic ExpectationsBlockBeats News, February 19, three researchers from the United States Federal Reserve believe that the prediction market Kalshi outperforms existing tools in real-time measurement of macroeconomic expectations, and therefore should be incorporated into the Federal Reserve's decision-making process. This research report, titled "The Rise of Kalshi and Macro Markets," was released on February 12. The authors are Anthony Diercks, Chief Economist at the Federal Reserve Board, Jared Dean Katz, Research Assistant at the Federal Reserve, and Jonathan Wright, Research Assistant at Johns Hopkins University. The study compares Kalshi's data with traditional surveys and market-implied forecasts to examine how market expectations for future economic outcomes change in response to macroeconomic news and policymakers' statements. "Managing expectations is at the core of modern macroeconomic policy. However, the tools we typically rely on—surveys and financial derivatives—have many shortcomings," the researchers stated, adding that Kalshi can "directly and in real time" capture the market's "beliefs." "The Kalshi market provides a high-frequency, continuously updated, and information-rich benchmark, which is valuable for both researchers and policymakers." "Overall, we believe Kalshi should be used to provide risk-neutral [probability density functions] regarding Federal Open Market Committee decisions at specific meetings," they argued, noting that the current benchmarks are "too far removed from monetary policy rate decisions." However, the Federal Reserve's research paper is only "preliminary material distributed to stimulate discussion" and will not influence the central bank's decisions. The Federal Reserve pointed out that one advantage of Kalshi in testing macroeconomic expectations is its "rich intraday dynamics." The researchers stated: "These probabilities respond quickly and reasonably to major developments." For example, after Federal Reserve Governors Christopher Waller and Michelle Bowman delivered speeches, the implied probability of a rate cut in July rose to 25%, but declined again after the June employment report exceeded expectations. The researchers added: "Kalshi provides the fastest-updating distributions currently available for many key macroeconomic indicators."

News