ARKB had a net outflow of about 87.5 million US dollars yesterday, while GBTC had a net outflow of 81.9 million US dollars

According to data from Farside Investors, the spot Bitcoin ETF ARKB launched by Ark Invest and 21Shares had a net outflow of about $87.5 million yesterday, marking the second consecutive day of net outflows. Grayscale's GBTC had a net outflow of $81.9 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MegaETH: How to Position Yourself Before the Official Launch on February 9?

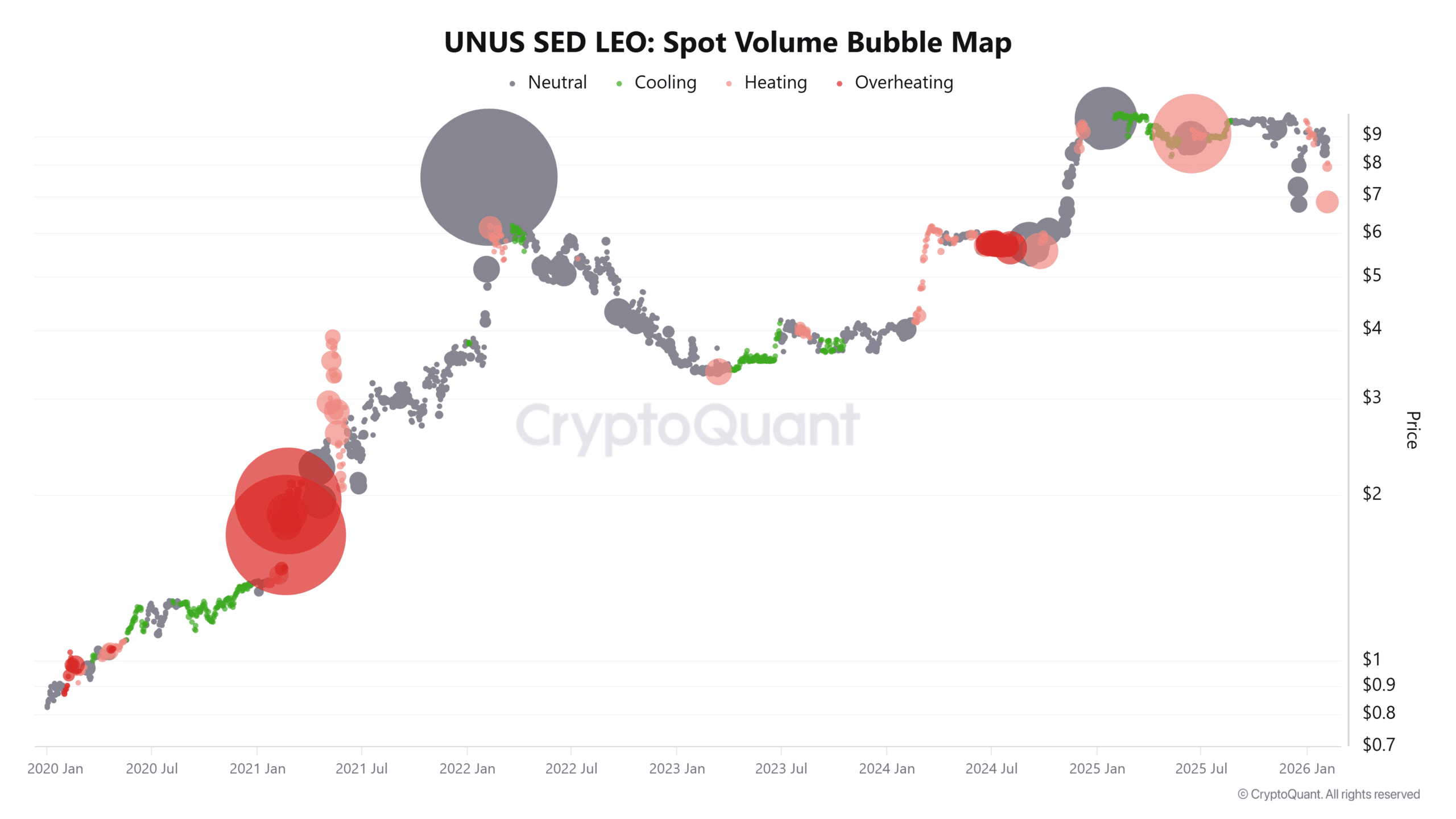

LEO’s 17% uptick – Traders, is this real conviction or beta chasing?

Zero Knowledge Proof Enters Stage 2 With 190M Daily Supply Cap While Uniswap & Monero Face Bearish Pressure

Netflix leads the streaming industry. It's no surprise that the company is seeking to reshape the market.