BHP Drops $60 Billion Anglo-American Deal Due to Market Instability and Regulatory Challenges

- China's Zhao Leji urged NZ economic ties in green energy/digital sectors during landmark visit, aligning with Beijing's five-year plan. - BHP abruptly canceled $60B Anglo-American merger due to volatile markets and regulatory hurdles, reversing 2024 proposal. - Modi praised G20 outcomes as global cooperation milestone, highlighting bilateral engagements with Japan/Italy leaders. - Snapchat introduced bank-linked age verification in Australia to comply with social media restrictions ahead of fines. - Cryp

During a historic visit, Zhao Leji, China's third-highest official, advocated for deeper economic ties with New Zealand, highlighting green energy, digital technology, and infrastructure as priority sectors for cooperation

Elsewhere, global financial markets responded to a significant corporate development as

In Asia, Indian Prime Minister Narendra Modi

Separately, in Australia, regulators saw Snapchat (SNAP) roll out a bank-integrated age verification feature to meet upcoming social media regulations

Cryptocurrency markets experienced renewed volatility as Strategy, a Bitcoin-centric company, joined others in urging a boycott of JP Morgan over proposed changes to the MSCI index

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. Natural Gas Prices Keep Falling as Milder Temperatures Approach

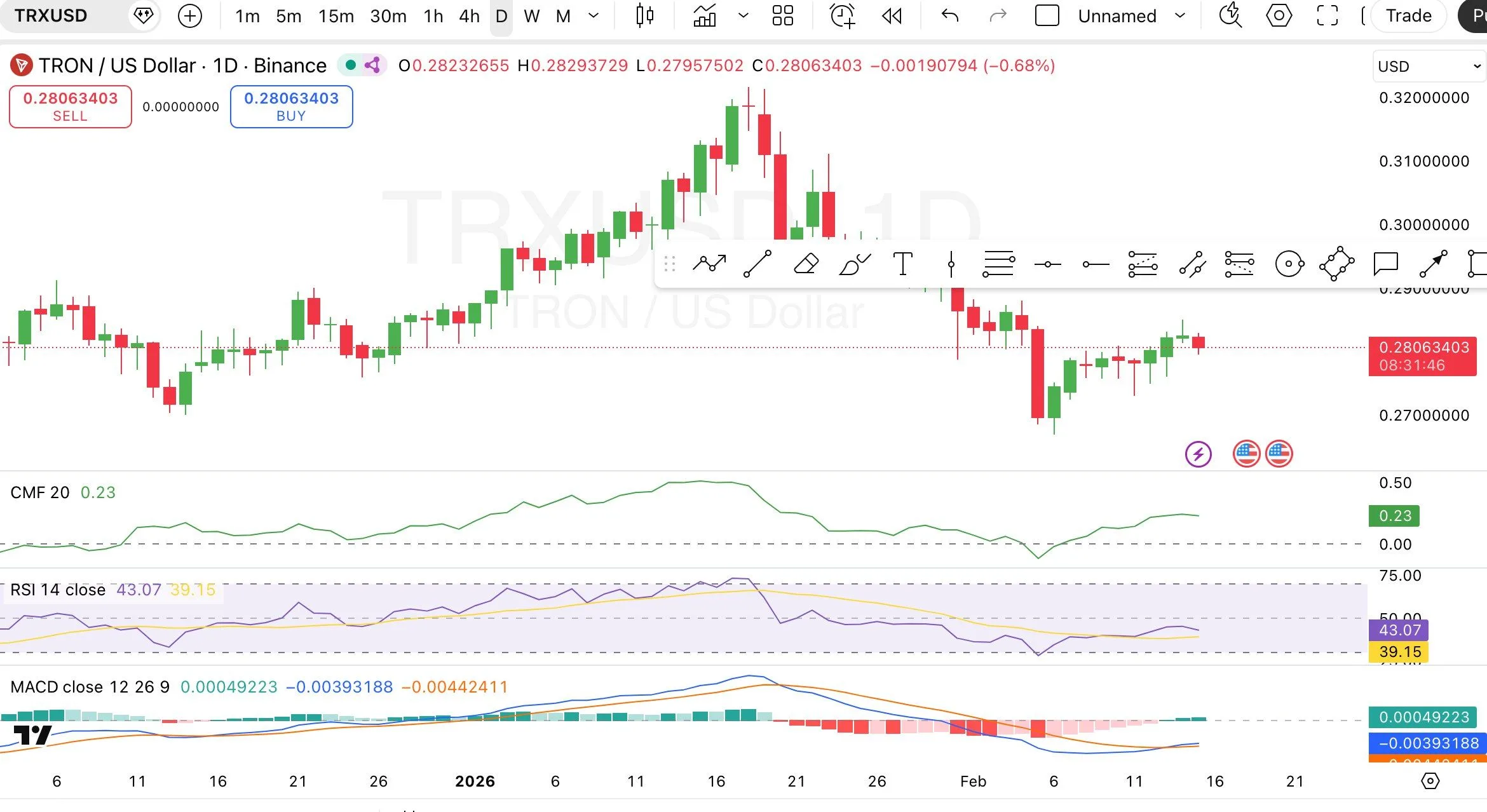

Justin Sun Expands TRX Treasury to 681M Tokens, TRON Price Rally?

Third of employers plan to reduce recruitment due to Labour’s proposed changes to workers’ rights

2 Stocks to Hold for the Next 5 Years