The ChainOpera AI Token Crash: An Alert for Cryptocurrency Initiatives Powered by AI

- ChainOpera AI token's 96% collapse in late 2025 exposed systemic risks in AI-driven crypto projects, highlighting governance, algorithmic, and regulatory flaws. - Centralized control by ten wallets and opaque AI models triggered liquidity crises and panic selling, undermining decentralization principles. - Regulatory ambiguity from the 2025 GENIUS and CLARITY Acts exacerbated instability, deterring institutional investment and amplifying market volatility. - Market sentiment shifted rapidly, with investo

The Convergence of Governance, Algorithms, and Regulation

The downfall of COAI can be traced back to a governance structure that contradicted the core ideals of decentralization.

Market Mood: From Optimism to Panic

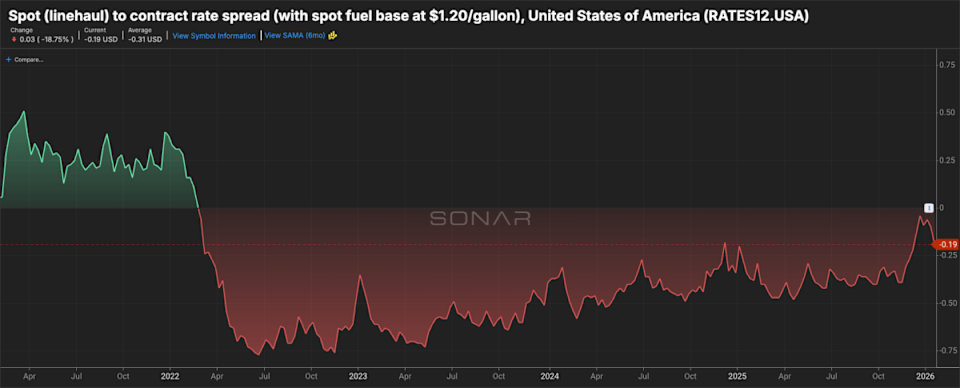

The 96% plunge in the COAI index was not just a technical breakdown—it was also a crisis of confidence. Social media was flooded with anxiety as investors recognized how fragile AI-powered crypto products could be. The turmoil at C3.ai, a major force in enterprise AI, only made things worse.

Those who once saw AI and crypto AI as reliable investments found themselves urgently seeking ways to reduce their risk.

Technical Analysis: Key Lessons Learned

The COAI debacle highlights three major threats facing AI-powered blockchain projects:

1. Centralized Decision-Making: ChainOpera’s dependence on a small group of wallets for governance created a critical vulnerability.

2. Lack of Algorithmic Transparency: The AI systems used to manage liquidity and pricing were neither properly tested nor open to scrutiny.

3. Regulatory Disconnect: The ambiguous language of the CLARITY Act and the strict requirements of the GENIUS Act underscore the necessity for regulatory frameworks that support both innovation and security.

The Path Forward: Prudence and Transparency

For AI-based crypto ventures to succeed, they must focus on openness, decentralization, and proactive engagement with regulators. At the same time, investors should approach these assets as speculative and high-risk.

Ultimately, the COAI collapse is more than just a warning—it’s a rallying cry. Both AI and blockchain are still developing, and moving forward will require better governance, clearer rules, and a healthy skepticism.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellantis-backed ACC shelves plans to open battery gigafactories in Italy and Germany

As market conditions shift, brokers have begun conducting stress tests

These 3 Altcoins Could Reach New Highs in February — RAIN, KITE, and STABLE

Dogecoin Price Prediction 2026: Degens Pivot to DeepSnitch AI’s 100x Presale as SHIB and DOGE Bleed, Vitalik Buterin Sells $6M Ether