BitGo IPO on the Brink: Can the Crypto Custody Giant Recreate Circle's Epic Surge?

BitGo, the undisputed leader in global crypto asset custody, is slated for a blockbuster listing on the U.S. stock market on January 22, 2026, with an expected IPO price range of $15 to $17 per share. Amid a strong resurgence in the crypto market, BitGo's IPO has become a major focal point. Reflecting on Circle's staggering 169% first-day surge and Bullish's impressive 84% gain, can BitGo replicate this listing legend with its dominant custody position and top-tier regulatory licenses?

This article provides an in-depth analysis through company comparisons, market dynamics, fundamental breakdowns, and future outlooks to help you make informed decisions.

I. Comparison of Recent Crypto Company IPO Performances

The crypto IPO wave is surging. Below is a curated selection of representative cases with first-day and cumulative gains, highlighting potential explosive opportunities:

- Circle: First-day gain of 169%, cumulative rise of 365%, with the offering price far exceeding expectations.

- Bullish (backed by Peter Thiel): First-day surge of nearly 84%, benefiting from strong brand endorsement.

- FIGR (the first RWA stock): First-day increase of over 24%, with a cumulative gain of 57% since listing.

- Gemini: First-day rise of only 14%, showing relatively conservative performance.

These cases reveal that first-day gains often depend on core competitiveness and timing. The explosive rallies of Circle and Bullish stemmed from powerful backing and market timing, while BitGo, as a custody infrastructure giant, could ignite a similar frenzy with its leading status.

II. Current Crypto Market Dynamics

- Bitcoin Price Rebound: Bitcoin recently hit a two-month high of $97,900, approaching the $100,000 threshold, signaling renewed market confidence.

- Policy Uncertainty: The U.S. Senate Banking Committee is set to vote on a cryptocurrency market structure bill, but disagreements between Wall Street banks and the crypto industry over stablecoin revenue sharing could lead to delays.

- Listing Wave: Since President Trump's positive stance on the crypto industry in 2025, numerous crypto firms have accelerated their IPO processes. Market reactions vary, with some companies delivering stellar first-day performances and others more subdued.

Bitcoin Price History Chart - All Time [2008-2026] Historical Data

These factors shape the macro environment for BitGo's listing: high volatility, but overall positive momentum prevails.

III. BitGo Company Fundamentals Analysis

1. Business Positioning

Founded in 2013, BitGo is one of the earliest and largest digital asset custody platforms globally, offering comprehensive services including wallets, custody, trade settlement, staking, and DeFi access. It supports over 1,400 crypto assets, including Bitcoin, Ethereum, stablecoins, and emerging tokens.

Currently, its custody assets under management exceed $104 billion (as of September 30, 2025, per updated S-1 filing data), far surpassing the initial $50 billion estimate. The company's core focus is on institutional-grade solutions, helping financial institutions, exchanges, and high-net-worth individuals securely store and manage digital assets.

Source: BitGo Holdings, Inc. Form S-1

Additionally, BitGo's Prime service integrates trading, clearing, and lending functions into a one-stop platform, supporting multi-chain environments such as Ethereum and its Layer 2s, Solana, and Bitcoin—this aligns closely with the multi-chain trends emphasized in a16z reports. BitGo has also expanded into NFT custody and Web3 infrastructure, serving clients in over 100 countries and facilitating traditional finance's transition into crypto.

2. Leading Market Position

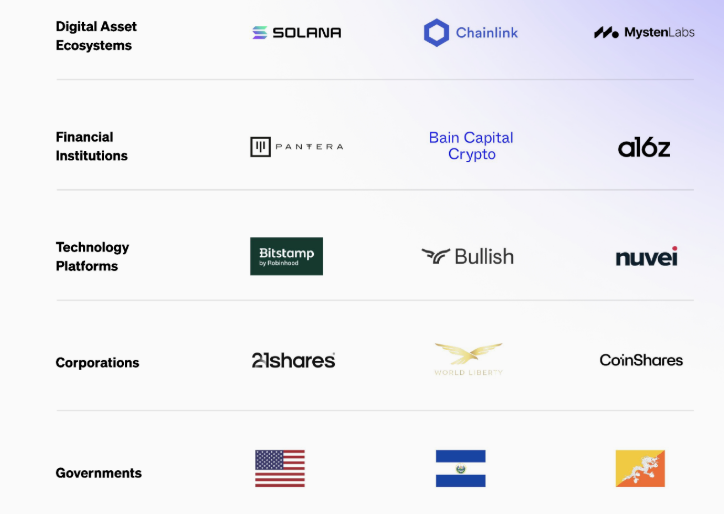

As the absolute leader in crypto custody, BitGo commands a dominant market share. Industry estimates place its share at 20%-30% based on assets under custody compared to competitors like Coinbase Custody and Fidelity Digital Assets. The company serves top global financial institutions and exchanges, including Galaxy Digital, Pantera Capital, and several Wall Street banks, supporting over 4,600 clients.

BitGo's innovative multi-signature (Multi-Sig) and multi-party computation (MPC) wallet technologies have become industry standards, enhancing security and reducing hacking risks—the company claims no major security incidents since inception. This technology unlocks digital asset potential for institutions, such as enterprise-grade staking services with annualized yields of 5%-15%.

Furthermore, through multiple acquisitions in 2025, including Prime Trust and several European custody firms, BitGo has strengthened its position and expanded its global infrastructure. In the developer ecosystem, BitGo's API integrations are widely adopted, boosting institutional adoption rates on chains like Ethereum and Solana.

3. Licensing Advantages

BitGo holds top-tier global regulatory licenses, setting it as an industry benchmark and providing unmatched compliance barriers and institutional trust. Per the S-1 filing and company website, key licenses include: U.S. OCC (Office of the Comptroller of the Currency) national trust bank license (BitGo Bank & Trust, making it one of the few crypto custodians with federal banking status).

Others include: New York NYDFS (Department of Financial Services) qualified custody license (BitLicense, a stringent New York state crypto permit); EU BaFin MiCAR license (covering custody, transfer, and trading services, compliant with new EU crypto regulations); UAE VARA (Virtual Assets Regulatory Authority) custody permit (key in the Middle East).

Additionally, it holds CCSS Level 3 highest security certification (CryptoCurrency Security Standard), SOC 1/2 audits (System and Organization Controls reports ensuring effective internal controls), and up to $250 million in insurance coverage (underwritten by Lloyd's of London).

These licenses surpass competitors like Coinbase, which holds only partial state-level permits, enabling BitGo to serve highly regulated institutional clients and avoid compliance risks. For instance, the OCC license allows federal-level trust services, attracting pension funds and sovereign wealth funds, bolstering its competitiveness in the global crypto custody market.

4. Financial Overview

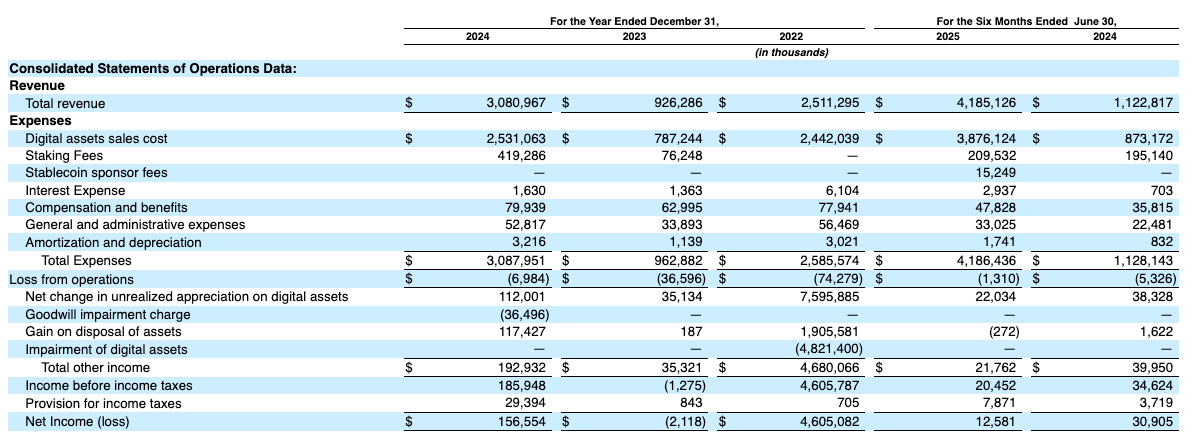

BitGo's financials exhibit the typical "revenue growth without profit growth" pattern of infrastructure companies. Based on the latest S-1 data, first-half 2025 revenue soared to nearly $4.2 billion, a 275% year-over-year increase from $1.12 billion in 2024; however, net profit fell 59% to $12.6 million from $30.9 million, primarily due to crypto market volatility pressuring custody and transaction fees, plus expansion costs.

This reflects BitGo's strategy of trading profits for market share—a common path for custody giants in early stages.

Source: BitGo Holdings, Inc. Form S-1

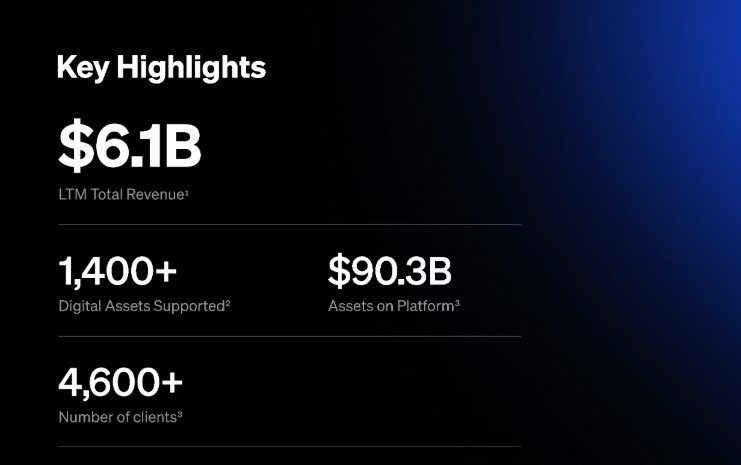

Key financial highlights (as of June 30, 2025, per S-1 data):

- LTM Total Revenue: Approximately $6.1 billion (last 12 months, combining 2024 full-year ~$3.08 billion and 2025 first-half data).

- Clients and Asset Support: Serving 4,600+ clients, supporting 1,400+ digital assets.

- Gross Margin: Core custody business stable at 60%-70%, primarily from custody fees (60%), trading/settlement fees (25%), and staking rewards/emerging services (like DeFi access, 15%).

- Assets Under Custody (AUM): $90.3 billion (end of June), grown to $104 billion (end of September), with a CAGR exceeding 50%.

- Balance Sheet: Total assets ~$32 billion, total liabilities $28.56 billion (mainly stablecoin custody deposits of $22.07 billion); cash and equivalents ~$55.586 million, healthy operating cash flow (positive in 2024, slightly negative but manageable in 2025 first half), low debt ratio, no high-leverage debt.

Source: BitGo Holdings, Inc. Form S-1

Future institutional inflows and multi-chain expansions will drive growth, with 2026 revenue projected above $8 billion, though profitability volatility warrants caution—market pullbacks or regulatory changes could impact custody fee income.

5. Risk Factors

Despite solid fundamentals, BitGo faces multiple risks. Regulatory tightening is a primary challenge, such as U.S. SEC scrutiny of custody operations, potentially requiring stricter disclosures and capital reserves, or delays in EU MiCAR implementation.

Competition intensifies from Coinbase Custody, Fidelity Digital Assets, and newcomers like Fireblocks, who are catching up on licenses and tech. High market volatility could shrink assets by 20%-30% in a bear market, affecting revenue.

The S-1 also notes cybersecurity risks—despite insurance, potential hacks remain—and geopolitical factors like U.S.-China trade tensions impacting global expansion. However, BitGo's licensing barriers and diversified business offer strong protection, with ~$1 billion in cash reserves to weather downturns.

Overall, risks are manageable but require monitoring macro crypto dynamics.

IV. IPO Outlook

BitGo will list on the NYSE (ticker: BTGO) on January 22, 2026, targeting a $1.96 billion valuation and raising up to $201 million. This IPO garners attention amid market recovery. Below is a brief analysis from optimistic factors, challenges, and recommendations.

- Optimistic Factors: If Bitcoin breaks $100,000, BitGo as custody infrastructure could see revenue growth of 30%+. Institutional capital inflows ($87 billion in ETF net inflows in 2025, more expected in 2026) may boost valuations, potentially replicating Circle's 169% first-day surge.

- Potential Challenges: Policy uncertainties (e.g., CLARITY Act delays, possibly until February) and market corrections (Bitcoin recently dipping to $93,000) could dampen first-day performance, leading to 20%-30% asset shrinkage.

- Investor Recommendations: Short-term, watch the $15-17 IPO price and opening; long-term, bullish on custody demand—suggest allocating 10%-20% portfolio. Overall cautiously optimistic, prioritize institutional configurations.

V. Conclusion

BitGo's listing is not just a milestone for crypto infrastructure but will inject new energy into the industry. With its custody leadership and top licenses, BitGo is poised to recreate explosive listing legends. Retail investors should rationally assess market and fundamentals, avoiding blind following. Next week's Senate vote will be a pivotal turning point.

Disclaimer: The above content is for reference only. Investing involves risks and should not be construed as any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Software shares surge as Wall Street rejects 'catastrophic outlook' for the sector

Solana Price Prediction: Alarming Head and Shoulders Pattern Could Push SOL Below $50

XRP Selling Pressure Triggers Alarming Bear Market Echo: Glassnode Warns of 2022 Pattern Repeat