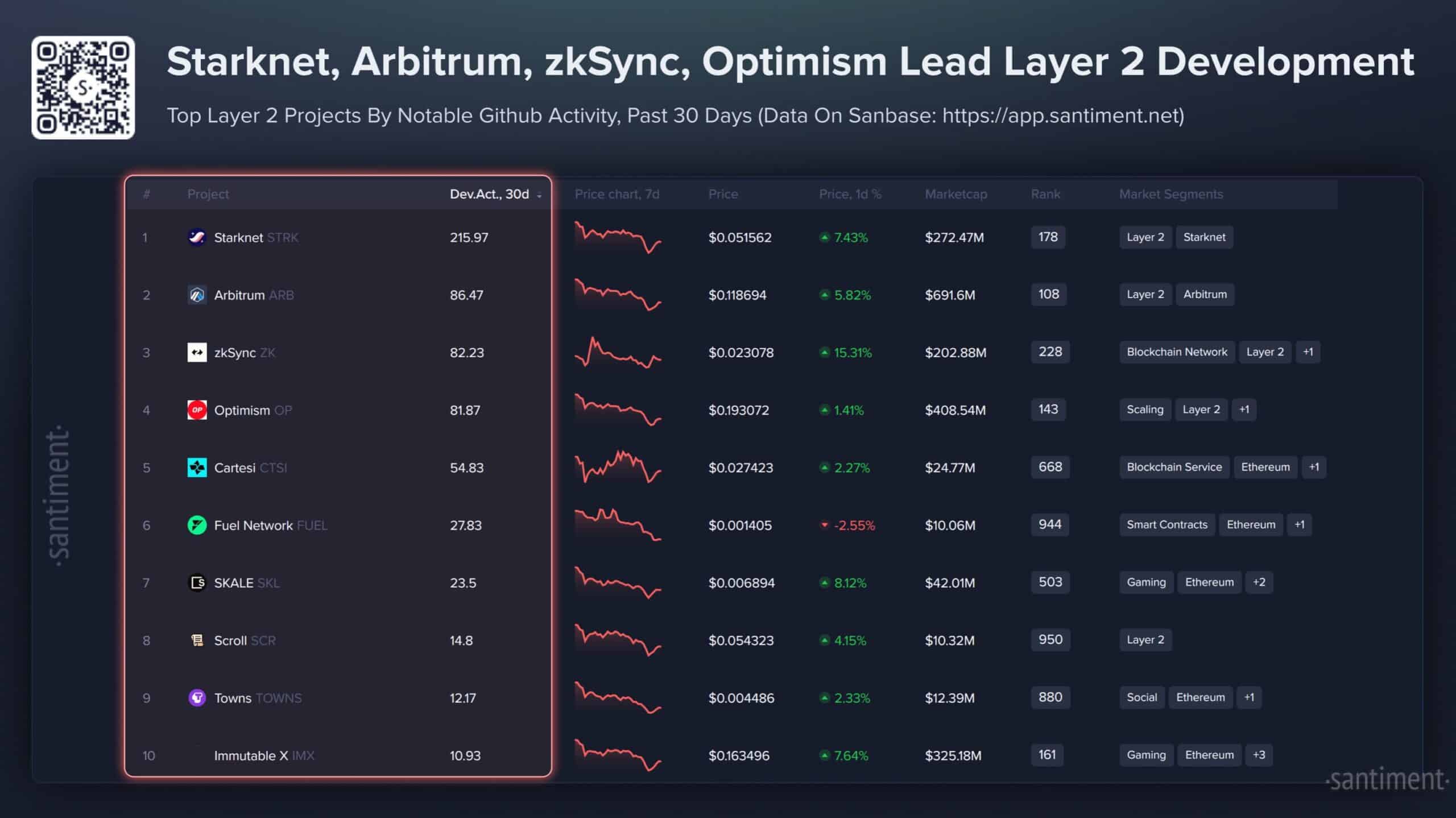

Starknet [STRK] was a leader among the Layer-2 projects by developmental activity, according to Santiment. This was a huge positive for long-term investors, who saw the token prices reach all-time lows.

High developmental activity, regardless of price action and market conditions, tends to separate the strong projects from the chaff.

Starknet was followed by Arbitrum [ARB] and zkSync [ZK]. Their 30-day activity scores were relatively lower compared to Starknet. Token Terminal data showed that Starknet was ranked 10th for active weekly users among Layer 2 blockchains.

The high-performance scaling solution for the Binance Smart Chain dominated L2 activity, followed by Arbitrum and Base. Compared by revenue, Starknet ranked a modest 6th among L2s.

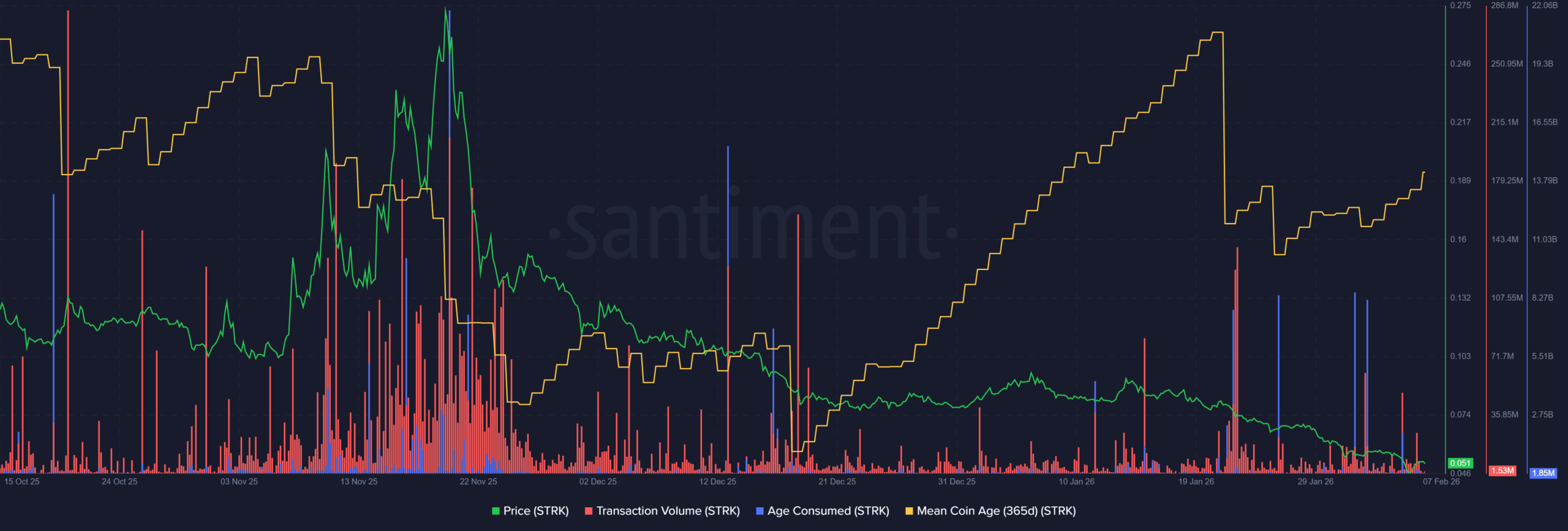

CoinMarketCap data showed that STRK was down 42% over the past month and has slid nearly 17% in a week. In the face of these dire stats, on-chain metrics looked slightly healthier than they did in the second half of 2025.

Starknet holders’ capitulation might be over

The age consumed metric has seen sizeable spikes over the past three weeks. At the same time, the 365-day mean coin age plummeted from 3-month highs. It showed increased token movement, which is understandable given the fear across the market.

Holders selling STRK also contributed to increased transaction volume, evidenced by spikes in the metric. This selling flurry can also signal heavy profit-taking activity, as it did in November when prices rallied to $0.27.

However, the mean coin age has begun to rise once again. This does not mark a price bottom by itself, but it was a slightly encouraging sign. Over the coming weeks, higher lows in the MCA metric would signal weaker waves of selling and more network-wide accumulation.

There are some other threats, such as a decline in Total Value Locked (TVL). AMBCrypto reported in mid-January that the TVL had reached the $300 million milestone for the first time since 2024.

This feat was only a brief victory lap for the investors. DeFiLlama stats showed that TVL has slid lower once again, reaching $289.45 million at press time.

Market conditions remain uncertain, and it may take time before TVL begins to rise again.

For long‑term investors, strong developmental activity offers some reassurance, but it’s still important to monitor metrics such as mean coin age and stablecoin liquidity to gauge the overall health of the L2.

Final Thoughts

- The Starknet holder conviction will be strengthened by the high 30-day developmental activity.

- STRK selling waves might be weakening if the mean coin age metric continues to ascend in the coming weeks, and age consumed remains low.