-

HYPE remains in consolidation despite strength, as the price is stuck below the $35 resistance, keeping the rally contained for now.

Crypto market volatility has intensified since the start of the month, with Bitcoin recording one of its sharpest single-day declines, dropping over $10,000. The sell-off triggered multiple liquidation cascades exceeding $2 billion, forcing leveraged positions out and creating conditions for buyers to step in near local lows.

As broader markets begin to stabilize, trader focus is shifting toward select altcoins showing relative strength and rising participation. While many tokens have bounced from oversold levels, only a few are displaying sustained momentum rather than short-term relief moves. Hyperliquid (HYPE) has emerged as a standout, with the price consolidating above a recently broken resistance level.

Although buying pressure has cooled in the short term, the HYPE price continues to show strength on higher timeframes, positioning the token for a potential volatility expansion if broader market conditions remain supportive.

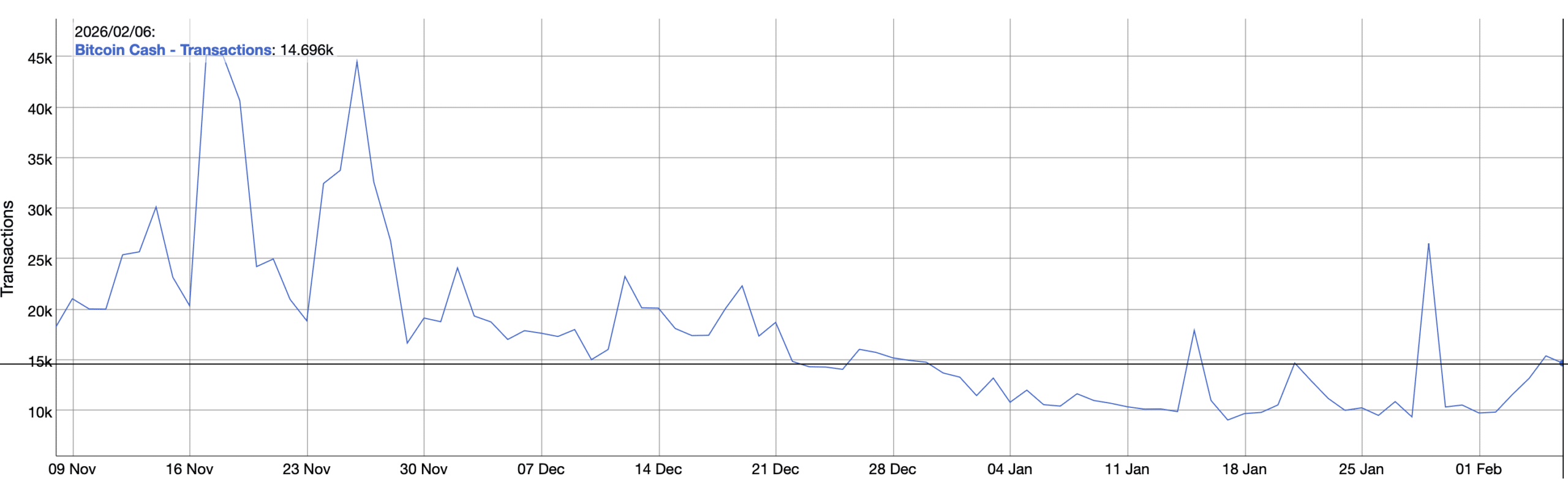

Looking at the daily chart, Hyperliquid (HYPE) price is currently trading in a tight zone where supply and demand are stacked closely together. This overlap explains why price has struggled to push higher, with repeated rejections keeping the move capped below the $35 level. Buyers are clearly stepping in on dips, but sellers continue to defend this area, resulting in sideways consolidation rather than a breakout.

That said, the Chaikin Money Flow (CMF) tells a more constructive story. The indicator shows a bullish divergence and is holding near the zero line, suggesting capital is still flowing into the asset despite muted price action. This points to accumulation rather than distribution.

From here, HYPE needs a clean daily and weekly close above $35 to shift momentum decisively. A successful breakout above $40 would significantly improve the odds of a move toward the $50 zone, where the chart shows relatively limited resistance.