A global asset sell-off with no one knowing the exact reason...

Show original

By:地平线全球策略

1/ This Bloomberg article is very well written. A global-level asset sell-off with no one knowing the exact cause is more about price movements that don't require a reason. When prices rise too much, they have to fall, and when they fall too much, they have to rise—this is the most natural thing. Ultimately, this is simply a result of a range of assets—from gold and silver, to the crypto market, to tech stocks—having grown excessively and now requiring a cleansing adjustment. This is a reset, because in the short term, the momentum of each asset class has already stretched itself to the limit.

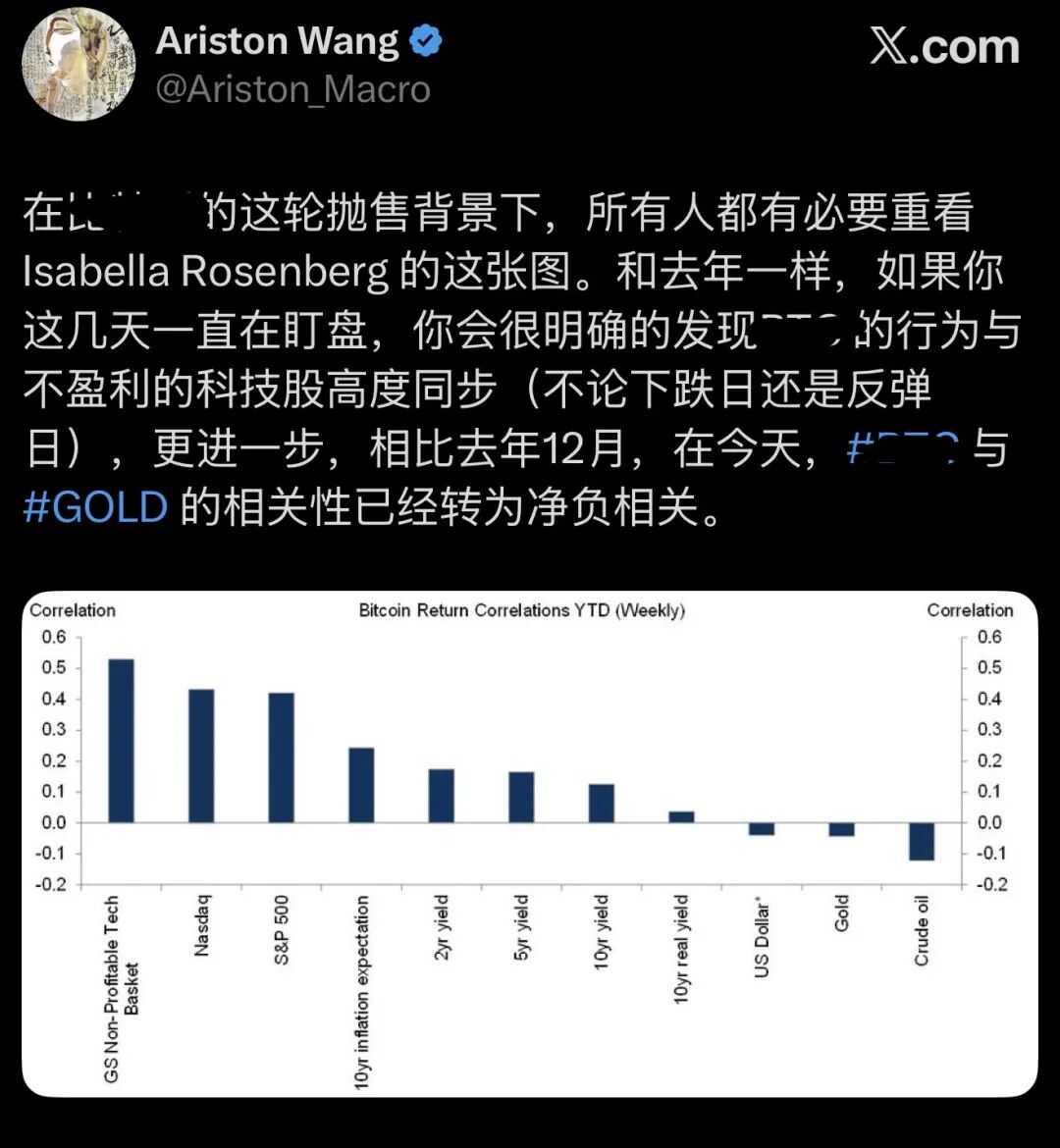

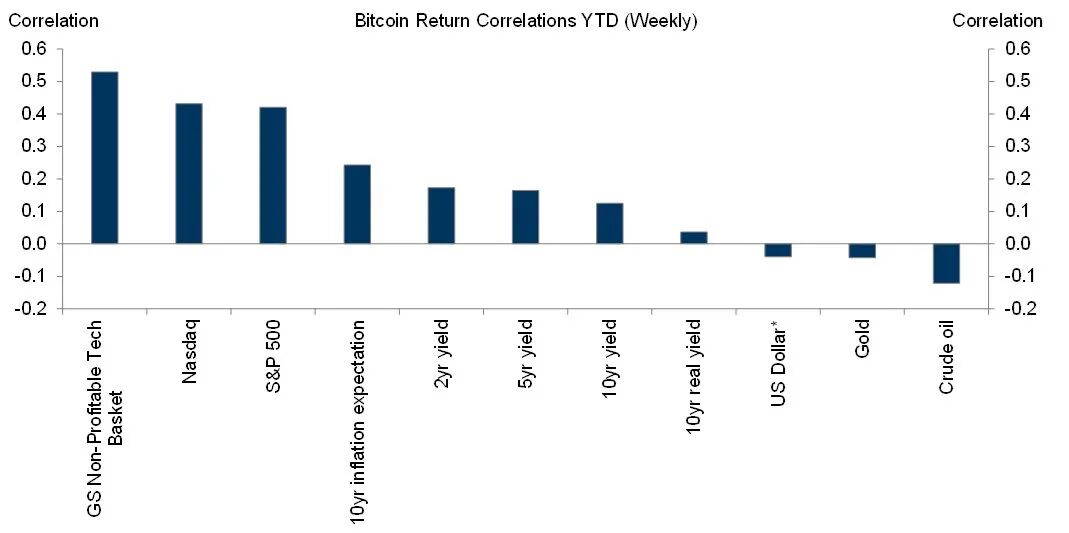

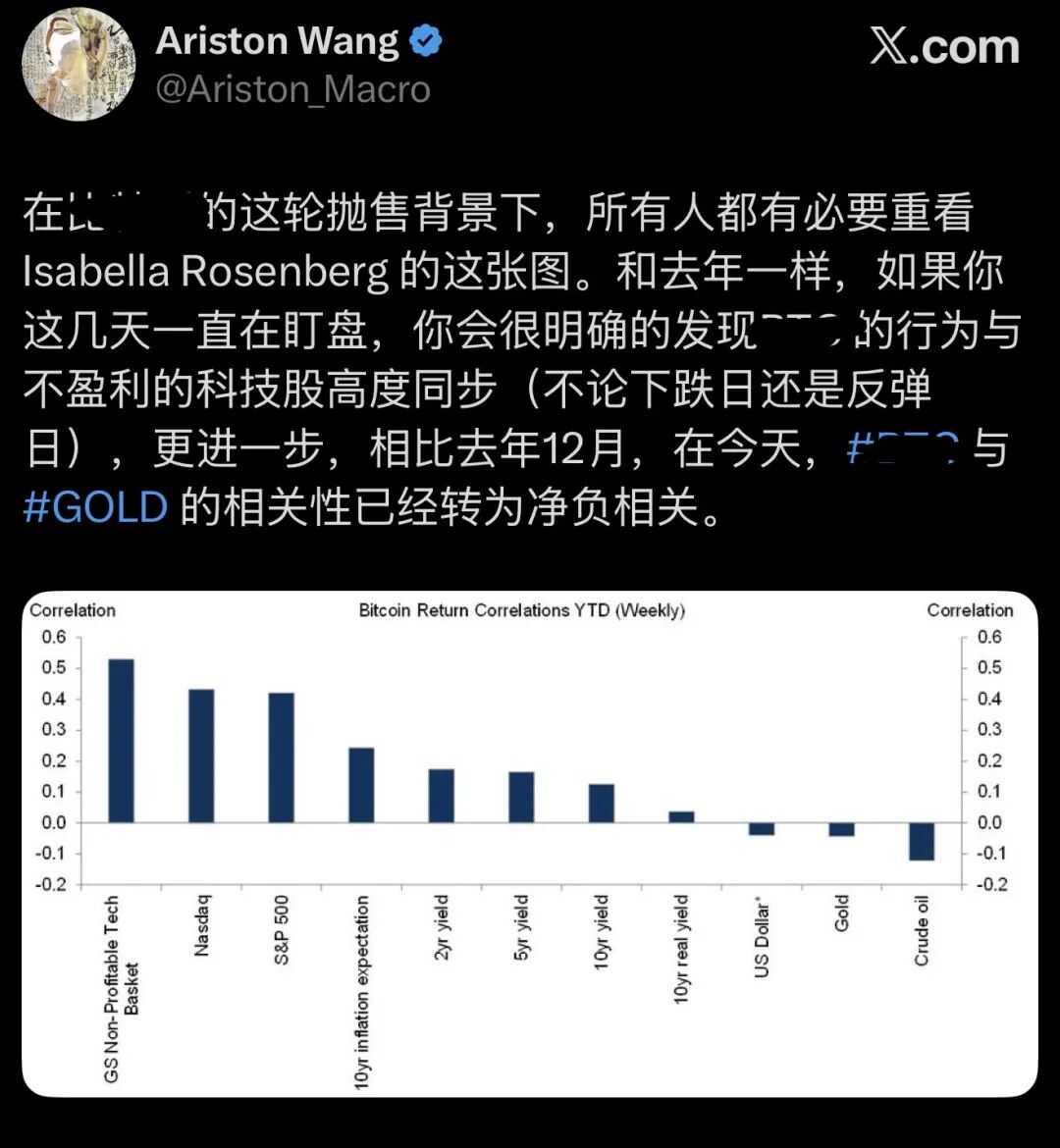

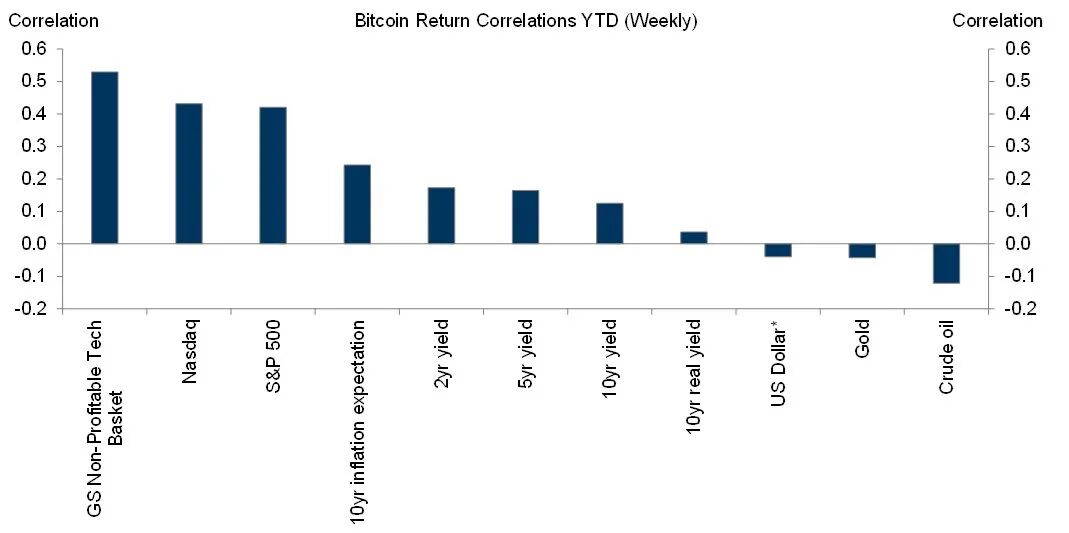

2/ Against the backdrop of this sell-off, everyone should take another look at Isabella Rosenberg’s chart. Just like last year, if you’ve been watching the markets closely these past few days, it’s very clear that the behavior of B is highly synchronized with unprofitable tech stocks (on both down days and rebound days).  Furthermore, compared to December last year, as of today, the correlation between B and gold has turned net negative.

Furthermore, compared to December last year, as of today, the correlation between B and gold has turned net negative.  3/ In the US, the beta of non-farm payrolls is rising. Cross-asset volatility is being lifted by a series of technical factors, including questions about the market’s response function to AI capital expenditure, the speed of recent market movements (particularly in commodities), and the overall long positioning in the market. But so far, from a cross-asset perspective, interest rate volatility remains relatively contained, mainly because the macro outlook hasn't truly changed.

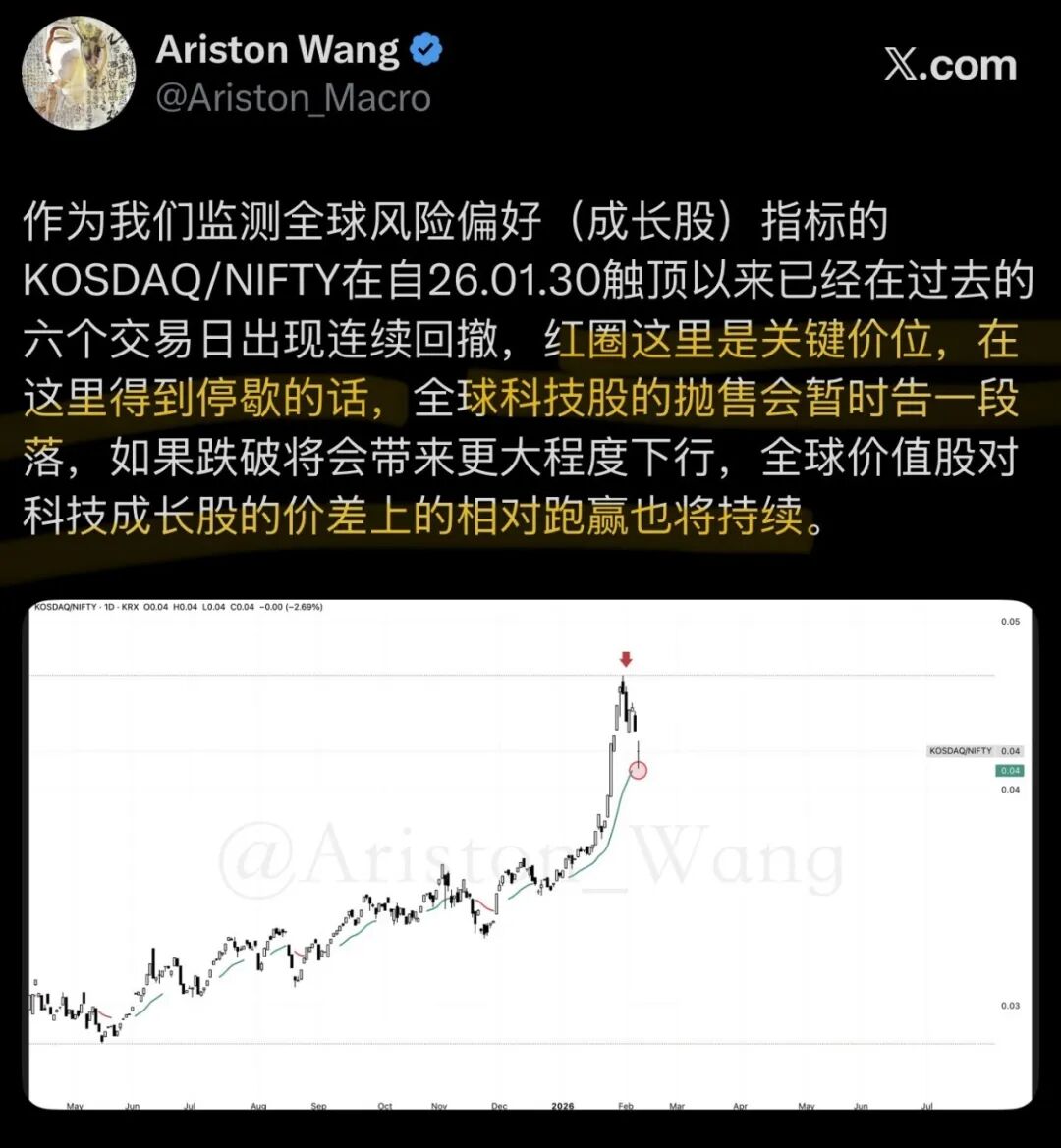

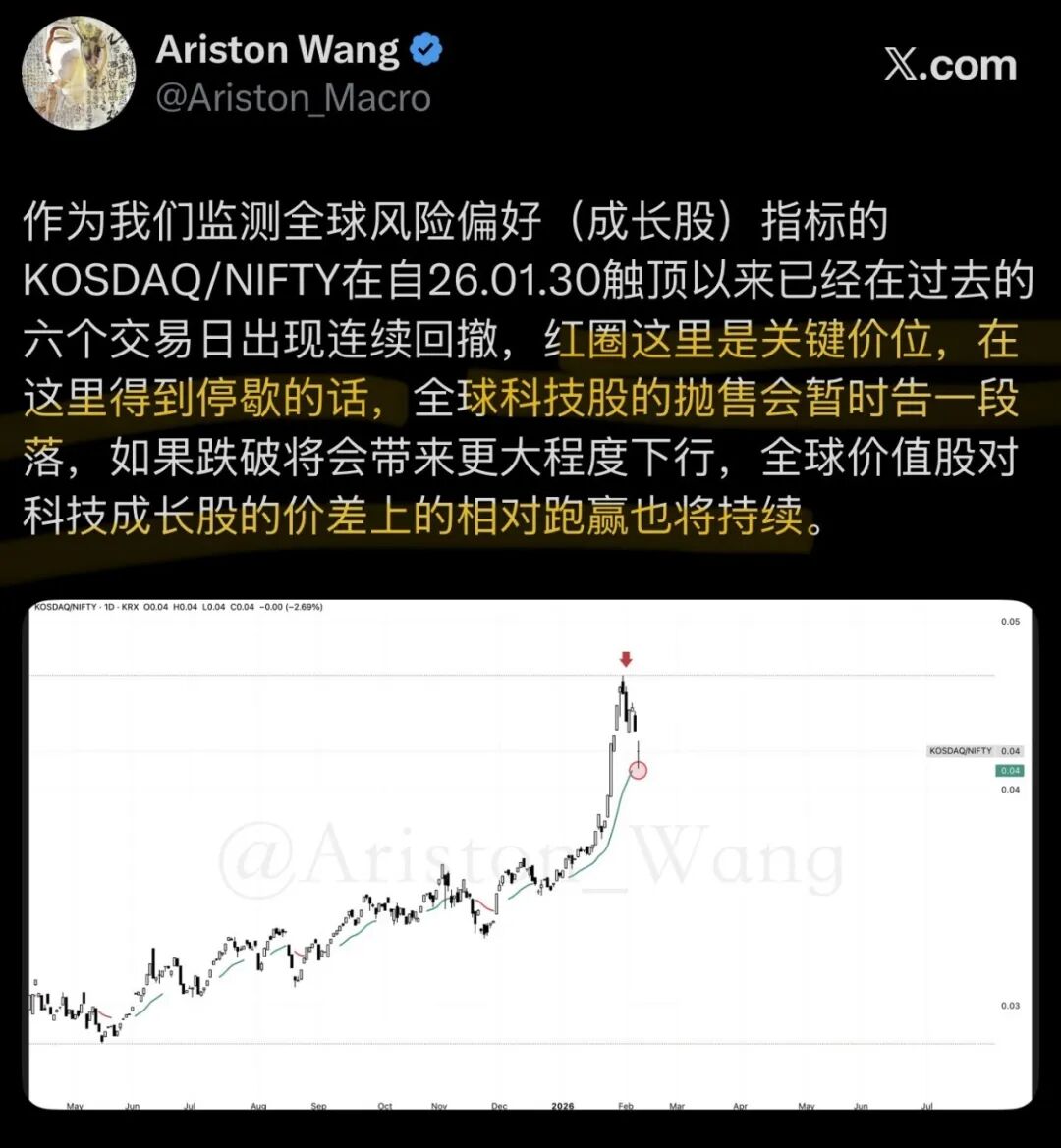

3/ In the US, the beta of non-farm payrolls is rising. Cross-asset volatility is being lifted by a series of technical factors, including questions about the market’s response function to AI capital expenditure, the speed of recent market movements (particularly in commodities), and the overall long positioning in the market. But so far, from a cross-asset perspective, interest rate volatility remains relatively contained, mainly because the macro outlook hasn't truly changed.  4/ As our indicator for monitoring global risk appetite (growth stocks), KOSDAQ/NIFTY has already seen a continuous pullback for six consecutive trading days since peaking on 26.01.30:

4/ As our indicator for monitoring global risk appetite (growth stocks), KOSDAQ/NIFTY has already seen a continuous pullback for six consecutive trading days since peaking on 26.01.30:  5/ We are closely watching TWD, ZAR, and GBP...

5/ We are closely watching TWD, ZAR, and GBP...  ... More content will be discussed in tonight's Cross-Asset Weekly.

... More content will be discussed in tonight's Cross-Asset Weekly.

Furthermore, compared to December last year, as of today, the correlation between B and gold has turned net negative.

Furthermore, compared to December last year, as of today, the correlation between B and gold has turned net negative.  3/ In the US, the beta of non-farm payrolls is rising. Cross-asset volatility is being lifted by a series of technical factors, including questions about the market’s response function to AI capital expenditure, the speed of recent market movements (particularly in commodities), and the overall long positioning in the market. But so far, from a cross-asset perspective, interest rate volatility remains relatively contained, mainly because the macro outlook hasn't truly changed.

3/ In the US, the beta of non-farm payrolls is rising. Cross-asset volatility is being lifted by a series of technical factors, including questions about the market’s response function to AI capital expenditure, the speed of recent market movements (particularly in commodities), and the overall long positioning in the market. But so far, from a cross-asset perspective, interest rate volatility remains relatively contained, mainly because the macro outlook hasn't truly changed.  4/ As our indicator for monitoring global risk appetite (growth stocks), KOSDAQ/NIFTY has already seen a continuous pullback for six consecutive trading days since peaking on 26.01.30:

4/ As our indicator for monitoring global risk appetite (growth stocks), KOSDAQ/NIFTY has already seen a continuous pullback for six consecutive trading days since peaking on 26.01.30:  5/ We are closely watching TWD, ZAR, and GBP...

5/ We are closely watching TWD, ZAR, and GBP...  ... More content will be discussed in tonight's Cross-Asset Weekly.

... More content will be discussed in tonight's Cross-Asset Weekly. 0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Markets are about to evaluate a Musk-led merger that pledges to deliver internet from space

101 finance•2026/02/08 12:09

Ripple Faces Critical $1.41 Price Barrier Challenge

Cointurk•2026/02/08 12:09

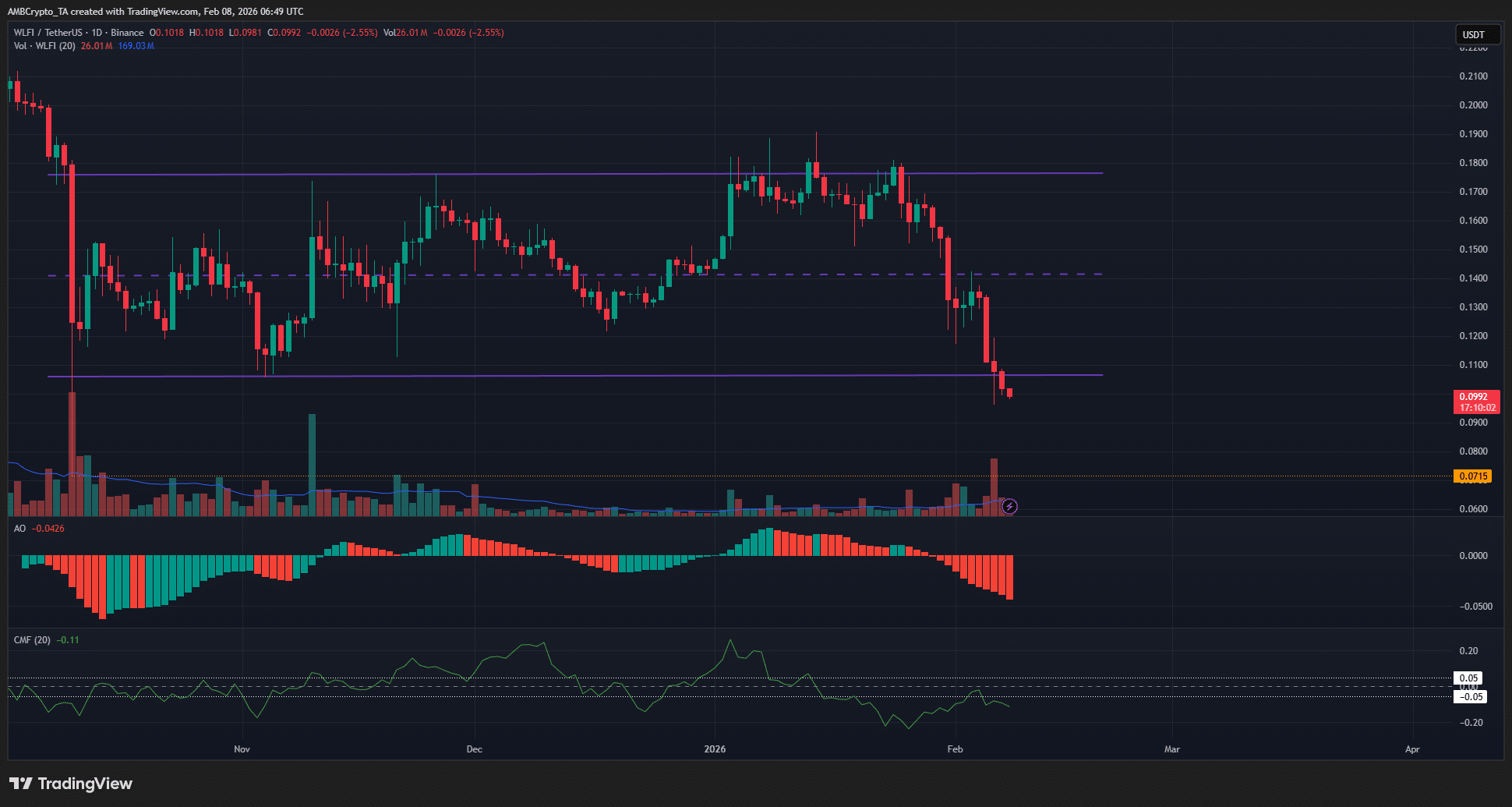

WLFI price prediction – Identifying short-term targets as sell pressure mounts

AMBCrypto•2026/02/08 12:03

Barclays reduces workforce amid push for AI and overseas operations

101 finance•2026/02/08 11:18

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$70,799.31

+2.92%

Ethereum

ETH

$2,125.02

+4.20%

Tether USDt

USDT

$0.9992

-0.01%

XRP

XRP

$1.45

+2.65%

BNB

BNB

$643.33

+0.62%

USDC

USDC

$0.9999

+0.01%

Solana

SOL

$88.01

+2.66%

TRON

TRX

$0.2785

+1.31%

Dogecoin

DOGE

$0.09792

+1.80%

Bitcoin Cash

BCH

$527.02

+1.16%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now