In the cryptocurrency markets, attention is focused on Ripple as XRP investors face a significant challenge. The $1.41 level, representing the 200-week moving average on the weekly chart, stands out as a crucial pivot point that will determine the price direction. Following sharp declines, the asset is attempting to stabilize in this region, presenting both a glimmer of hope and a substantial risk for market participants.

Test at the 200-Week Average

According to TradingView data, XRP’s price, after a sharp pullback from the distribution phase in the $3.3 – $3.6 range, returned to the 200-week moving average at $1.41. This level, which has historically served as robust support, currently functions as a “test of acceptance” area rather than a “victory bounce.” Although the price remaining flat in this area suggests that investors have yet to capitulate, the lack of a strong upward momentum is notable.

It is crucial for the cryptocurrency to close above $1.41 on a weekly basis to maintain the bull scenario and expectations of a broad super cycle. If this level is preserved as a base, the current pullback could be seen as a healthy correction. Conversely, if weekly candle bodies fall below this line, the validity of the rising trend might be compromised.

Despite the general pessimism in the market, XRP continues to attract institutional interest, as evidenced by weekly ETF inflows amounting to $45 million. Ripple executives being invited to the White House and Elon Musk’s interactions within the sector keep fundamental analysis expectations for XRP vibrant. Technically, any move not reaching $2 remains a reactive rally, while defending $1.41 could mark the 2026 low.

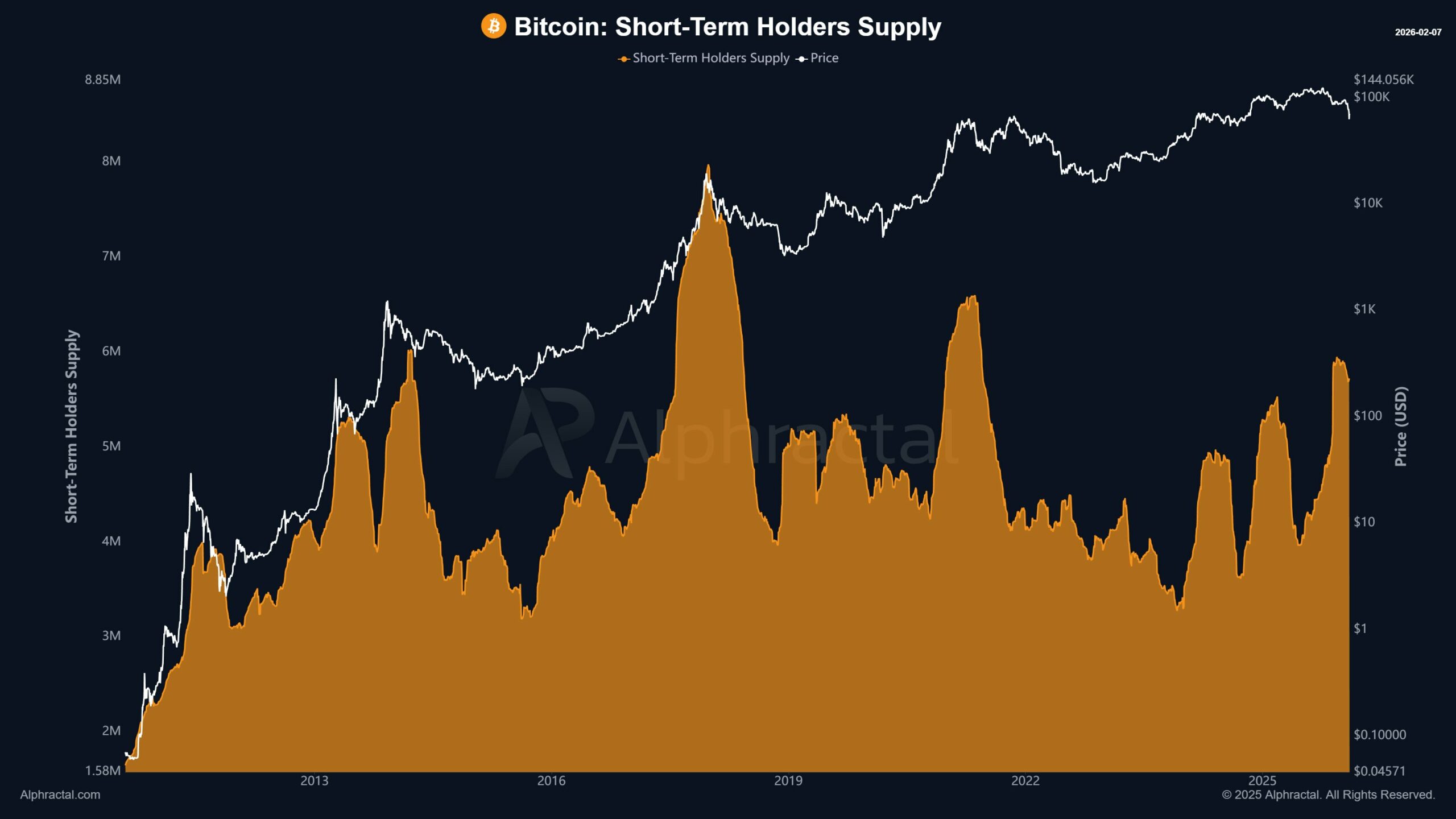

Structural Weakness Behind Rapid Decline

XRP, having lost 30% of its value in just one week, fell victim to gaps created by vertical rises. The inability to establish a permanent price structure in the $1.6 – $2 range eliminated the steps needed to withstand selling pressure. The breakdown in the distribution zone and the subsequent free fall demonstrated how speculative the upward momentum was.

If the 200-week average is lost, the next major demand zone is expected to be at or below $1. Technical indicators suggest that a break below $1.41 could trigger a deeper correction to address “unfinished business” left from the accumulation phase. For investors, the $2.4 and $3 levels currently serve as massive hurdles rather than clear paths forward.

The progression of this process seems to hinge on the continuity of institutional entries and macroeconomic news flow. While Ripple’s political interactions and movements by figures like Vitalik Buterin in other assets shake the overall market, whether XRP can maintain this level internally will directly affect 2026 projections. Each closure of the price in this region serves as the most significant proof in determining the direction of the long-term trend.