Significant Increase in Capital Expenditures Will Squeeze Funding for Google, Amazon, and Meta

Tech giants are planning to significantly increase capital expenditures this year, which will almost exhaust the free cash flow of Amazon, Google, and the metaverse platform. This will force some of these companies to make tough decisions, such as whether to halt stock buybacks or take on more debt.

The good news is that these tech giants have the capacity to raise hundreds of billions of dollars in additional debt, far exceeding their current liabilities.

In recent years, most tech giants have begun returning cash to shareholders through dividends and stock buybacks, with Google and the metaverse platform being prime examples of using both methods. But this approach may not be sustainable this year—as capital expenditures to expand AI computing power will nearly consume all cash generated from operating activities.

Google and the metaverse platform have already started to scale back stock buybacks. However, canceling dividends is much trickier, as both companies only introduced dividend policies for the first time in 2024, and this policy has significantly increased their stocks' attractiveness to investors.

Amazon does not face this dilemma: the company has not conducted stock buybacks since 2022 and has never paid dividends. However, according to S&P Global Market Intelligence, Amazon plans to spend $200 billion on capital expenditures this year, higher than analysts' estimate of $178 billion in operating cash flow, meaning that unlike the other two companies, Amazon will inevitably see a cash drain this year.

Last November, Amazon issued $15 billion in bonds to bolster its cash reserves, and as of December 31, it held $123 billion in cash, providing ample buffer. However, according to The Information, Amazon is currently in talks to invest tens of billions of dollars in OpenAI, which would significantly reduce its cash reserves. Last Friday, Amazon filed a registration statement with the U.S. Securities and Exchange Commission, enabling it to issue debt quickly—a signal of its intention to raise additional funds.

Microsoft is in a somewhat different position, as its capital expenditure expansion is much less aggressive than the others. In the first half of fiscal year 2026 (ending in June), Microsoft's capital expenditures were $49 billion, while operating cash flow for the same period reached $80 billion, easily covering its spending. According to S&P Global Market Intelligence, analysts estimate its total capital expenditures for fiscal 2026 at $103 billion, with free cash flow still reaching $66 billion—a slight decrease from fiscal 2025. Microsoft has stated that capital expenditure growth in fiscal 2026 will outpace last year (fiscal 2025 capital expenditures grew 45% to $65 billion), but unlike other companies, it has not disclosed the specific annual figure for capital expenditures.

Although Microsoft will likely continue to generate considerable free cash flow, it faces a constraint that other companies do not—a massive dividend commitment. Microsoft's dividend payout last fiscal year reached $24 billion, and this year it has already increased its dividend rate by 10%.

In comparison, the metaverse platform and Google paid $5 billion and $10 billion in dividends last fiscal year, respectively. Theoretically, both companies can still afford this level of dividend payout this year, but the metaverse platform will be under particularly significant financial pressure. The parent company of Facebook spent $26 billion on stock buybacks last year, a slight decline from 2024, but with free cash flow expected to shrink substantially this year, its buyback scale will likely be drastically reduced.

Like Amazon, the metaverse platform and Google also issued bonds last year to bolster their cash reserves. All three companies still have ample remaining borrowing capacity. Take Google as an example: credit rating agency S&P stated last November that even if Google's net debt rose to over $200 billion, its high AA+ credit rating would only then be at risk of a downgrade. Currently, Google's total debt is only $47 billion, while it holds $127 billion in cash—fully covering its liabilities, meaning it currently has no net debt.

According to S&P, analysts estimate that in 2026, Google's EBITDA will be $218 billion. In theory, if Google were willing to accept a credit rating downgrade, its borrowing could reach twice that profit, or $400 billion.

Oracle is the company that has significantly overdrawn its balance sheet to expand AI computing power. As of November 30, Oracle's net debt was about $88 billion, more than twice the $35.5 billion in EBITDA analysts estimate it will generate in fiscal 2026. Currently, Oracle is raising $45 billion to $50 billion through bond and stock offerings to finance its data center expansion project.

Even while in a cash burn state, Oracle still plans to pay $5.7 billion in dividends this year. But investors have responded negatively: so far this year, Oracle's share price has fallen 27%.

Editor: Guo Mingyu

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dollar faces heightened examination as Chinese banks reduce reliance on USD

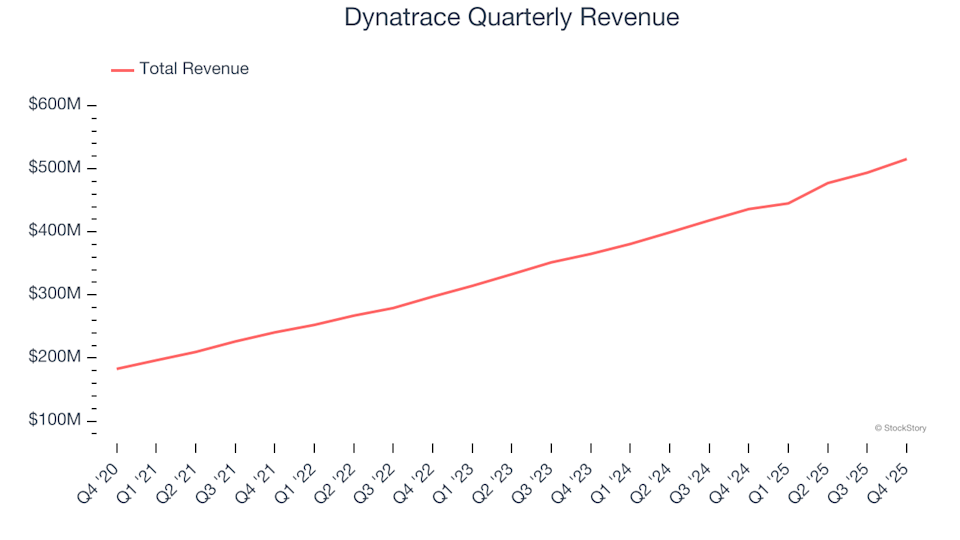

Dynatrace (NYSE:DT) surpasses Q4 CY2025 revenue expectations, shares surge 10%

Oracle receives both upgrade and downgrade: Leading Wall Street analyst opinions

Bitwise to Include XRP in DeFi Vault Program Amid Upcoming Regulatory Clarity