U.S. Bitcoin ETFs Lose $410M Amid Ongoing BTC Weakness

On Thursday, U.S.-listed spot Bitcoin ETFs experienced their second straight day of net outflows, wiping out the gains seen earlier in the week. A modest inflow followed on Friday, hinting at a slight pickup in buying interest, even as Bitcoin continues to struggle around $68,000.

In Brief

- U.S. spot Bitcoin ETFs experienced $410 million in outflows on Thursday following a similar decline the day before.

- Friday saw a small rebound with $24 million flowing back into the funds, suggesting mild buying interest.

- Analysts warn that BTC could fall further toward $50,000, while Ethereum may reach around $1,400 before a potential recovery.

Bitcoin ETFs See Major Outflows

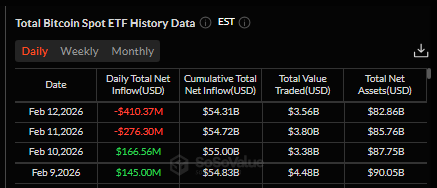

Data from SoSoValue shows that U.S. spot Bitcoin ETFs experienced $410.37 million in outflows on Thursday, following Wednesday’s $276.30 million. Over the two days, total withdrawals reached $686 million. The outflows were concentrated as follows:

- BlackRock’s IBIT led with $157.6 million

- Fidelity’s FBTC recorded $104.1 million in outflows

- Grayscale’s GBTC and BTC funds accounted for $59.1 million and $33.5 million, respectively, with the remainder spread across other Bitcoin-focused ETFs

Total Daily Bitcoin Spot ETF Flow Data Overview

Total Daily Bitcoin Spot ETF Flow Data Overview

Friday brought a modest recovery, with $24.56 million flowing back into the funds, led by Fidelity’s FBTC, which captured $11.99 million of the total. Although this uptick offered a brief reprieve, the broader trend remains weak, as Glassnode reports that the 30-day simple moving average of net flows for Bitcoin and Ethereum ETFs has stayed negative over the past three months, highlighting persistent caution among investors. Still, Bitcoin ETFs have accumulated $54.34 billion in net inflows since their inception and now control assets equivalent to roughly 6.3% of BTC’s total market capitalization.

Analyst Predicts Further Losses as Bitcoin Struggles

Bitcoin has declined about 45% from its all-time high, trading near $68,000 at the time of writing. Geoffrey Kendrick, head of digital assets research at Standard Chartered, warned that the market could see further losses before recovering. He projected BTC could drop toward $50,000 and Ethereum to around $1,400, levels he sees as potential buying opportunities ahead of year-end forecasts of $100,000 for Bitcoin and $4,000 for Ethereum.

The analyst’s outlook comes as the largest cryptocurrency has experienced notable swings over the past few weeks. It climbed from around $87,000 to nearly $98,000 in mid-January after a two-week rally, only to drop sharply to $60,000 in early February—a decline that coincided with significant outflows from Bitcoin-focused funds. While it has partially recovered since then, the cryptocurrency continues to struggle to break past $71,000.

Options Market Shows Rising Interest and Volatility

Amid Bitcoin’s consolidation, BTC options open interest is climbing, approaching the peak recorded at the end of Q4 2025. According to Glassnode, open interest increased to 452,000 BTC from 255,000 BTC following the December 26 expiry. At the same time, implied volatility for one- and three-month at-the-money (ATM) options has risen roughly 10 percentage points in recent weeks, suggesting traders are pricing in the possibility of larger near-term price swings.

Even with recent outflows and volatility, the overall picture for Bitcoin ETFs remains significant. The funds continue to hold a meaningful portion of the market, and any shifts in investor sentiment or inflows could have a pronounced effect on Bitcoin’s price trajectory.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Devon Energy Bets on Scale With Coterra Acquisition

‘If you want to be great, make enemies’: Solana economist Max Resnick

TotalEnergies (TTE) Expands EV Charging Network in Belgium and Netherlands