VeriSign Stock: Does Wall Street Have a Positive or Negative Outlook?

VeriSign, Inc.: Company Overview and Recent Performance

Headquartered in Reston, Virginia, VeriSign, Inc. (VRSN) specializes in providing essential internet infrastructure and domain name registry services, supporting navigation for a wide range of well-known domain extensions. The company currently holds a market capitalization of $20.1 billion.

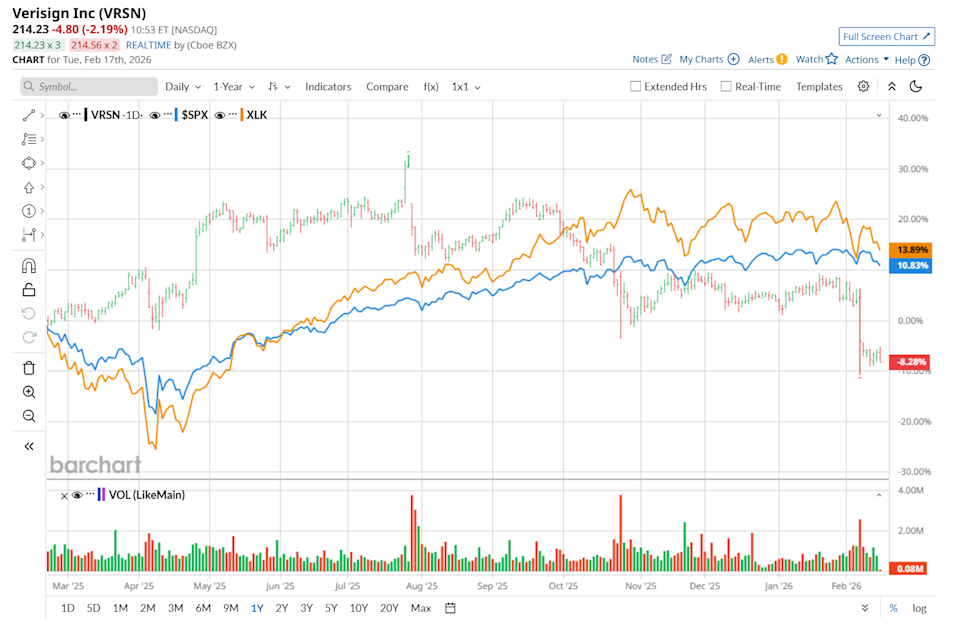

Stock Performance Compared to the Market

Over the past year, VeriSign's stock has trailed the overall market. While the S&P 500 Index ($SPX) advanced by 11.8% during this period, VRSN shares fell by 5.1%. Year-to-date, the stock has dropped 10.4%, whereas the S&P 500 experienced only a slight decline.

Comparison with Technology Sector ETF

Looking more closely, VRSN has also lagged behind the State Street Technology Select Sector SPDR ETF (XLK), which posted a 14.8% gain over the last 52 weeks and a 4.3% decrease year-to-date.

Recent Financial Results

VeriSign released its fourth-quarter earnings on February 5, after which the stock dropped by 7.6% in the next trading session. The company reported a 7.6% year-over-year increase in revenue, reaching $425.3 million. Earnings per share rose 11.5% to $2.23 compared to the same period last year, but these results did not meet analyst expectations, which may have unsettled investors. During the quarter, VeriSign processed 10.7 million new .com and .net domain registrations, up from 9.5 million in the corresponding quarter of 2024.

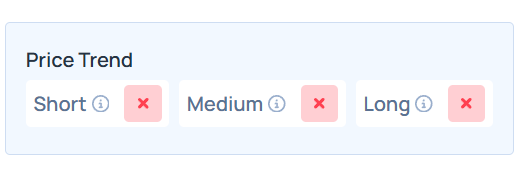

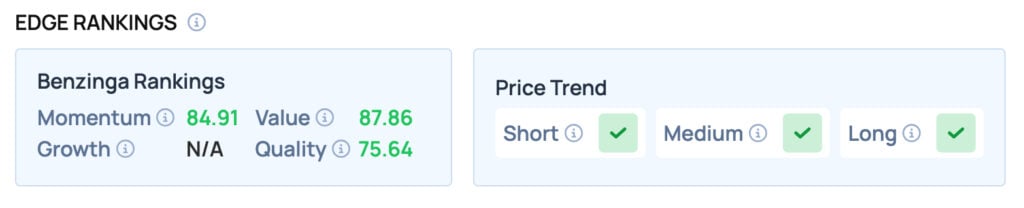

Analyst Forecasts and Ratings

Looking ahead to fiscal year 2026, which concludes in December, analysts anticipate that VeriSign's earnings per share will grow by 5.2% year-over-year to $9.27. In the most recent quarter, the company missed consensus EPS estimates by 2.6%.

Among the four analysts tracking the stock, the consensus is a "Moderate Buy," with two rating it as a "Strong Buy" and two as a "Hold."

Analyst sentiment has become more optimistic compared to the previous month, when one analyst had issued a "Strong Sell" recommendation.

Price Targets and Potential Upside

On February 9, Citigroup Inc. (C) reaffirmed its "Buy" rating for VeriSign but reduced its price target to $280, suggesting a potential upside of 30.4% from current levels. The average price target stands at $285.33, indicating a possible 32.9% increase, while the highest target of $305 represents a 42% upside.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Jim Farley Says Ford's Universal EV Platform Is Important To 'Win Against China'

Facing AI Competition Threat, Pinterest Launches "Red Alert" Project