Home Depot (HD) Stock Declines While Market Improves: Some Information for Investors

In the latest close session, Home Depot (HD) was down 2.05% at $383.04. This change lagged the S&P 500's 0.1% gain on the day. At the same time, the Dow added 0.07%, and the tech-heavy Nasdaq gained 0.14%.

Coming into today, shares of the home-improvement retailer had gained 2.86% in the past month. In that same time, the Retail-Wholesale sector lost 5.35%, while the S&P 500 lost 1.43%.

The investment community will be closely monitoring the performance of Home Depot in its forthcoming earnings report. The company is scheduled to release its earnings on February 24, 2026. It is anticipated that the company will report an EPS of $2.51, marking a 19.81% fall compared to the same quarter of the previous year. Simultaneously, our latest consensus estimate expects the revenue to be $38.25 billion, showing a 3.65% drop compared to the year-ago quarter.

HD's full-year Zacks Consensus Estimates are calling for earnings of $14.5 per share and revenue of $164.7 billion. These results would represent year-over-year changes of -4.86% and +3.25%, respectively.

It is also important to note the recent changes to analyst estimates for Home Depot. Recent revisions tend to reflect the latest near-term business trends. As a result, upbeat changes in estimates indicate analysts' favorable outlook on the business health and profitability.

Research indicates that these estimate revisions are directly correlated with near-term share price momentum. To take advantage of this, we've established the Zacks Rank, an exclusive model that considers these estimated changes and delivers an operational rating system.

The Zacks Rank system, ranging from #1 (Strong Buy) to #5 (Strong Sell), possesses a remarkable history of outdoing, externally audited, with #1 stocks returning an average annual gain of +25% since 1988. Over the past month, the Zacks Consensus EPS estimate has shifted 0.09% downward. Home Depot is holding a Zacks Rank of #3 (Hold) right now.

In terms of valuation, Home Depot is currently trading at a Forward P/E ratio of 25.85. This denotes a premium relative to the industry average Forward P/E of 22.05.

We can also see that HD currently has a PEG ratio of 13.97. The PEG ratio is similar to the widely-used P/E ratio, but this metric also takes the company's expected earnings growth rate into account. By the end of yesterday's trading, the Retail - Home Furnishings industry had an average PEG ratio of 2.12.

The Retail - Home Furnishings industry is part of the Retail-Wholesale sector. Currently, this industry holds a Zacks Industry Rank of 168, positioning it in the bottom 32% of all 250+ industries.

The Zacks Industry Rank evaluates the power of our distinct industry groups by determining the average Zacks Rank of the individual stocks forming the groups. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1.

Remember to apply Zacks.com to follow these and more stock-moving metrics during the upcoming trading sessions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Ready To Bounce Again? The Major Accumulation Trend You Should Be Aware Of

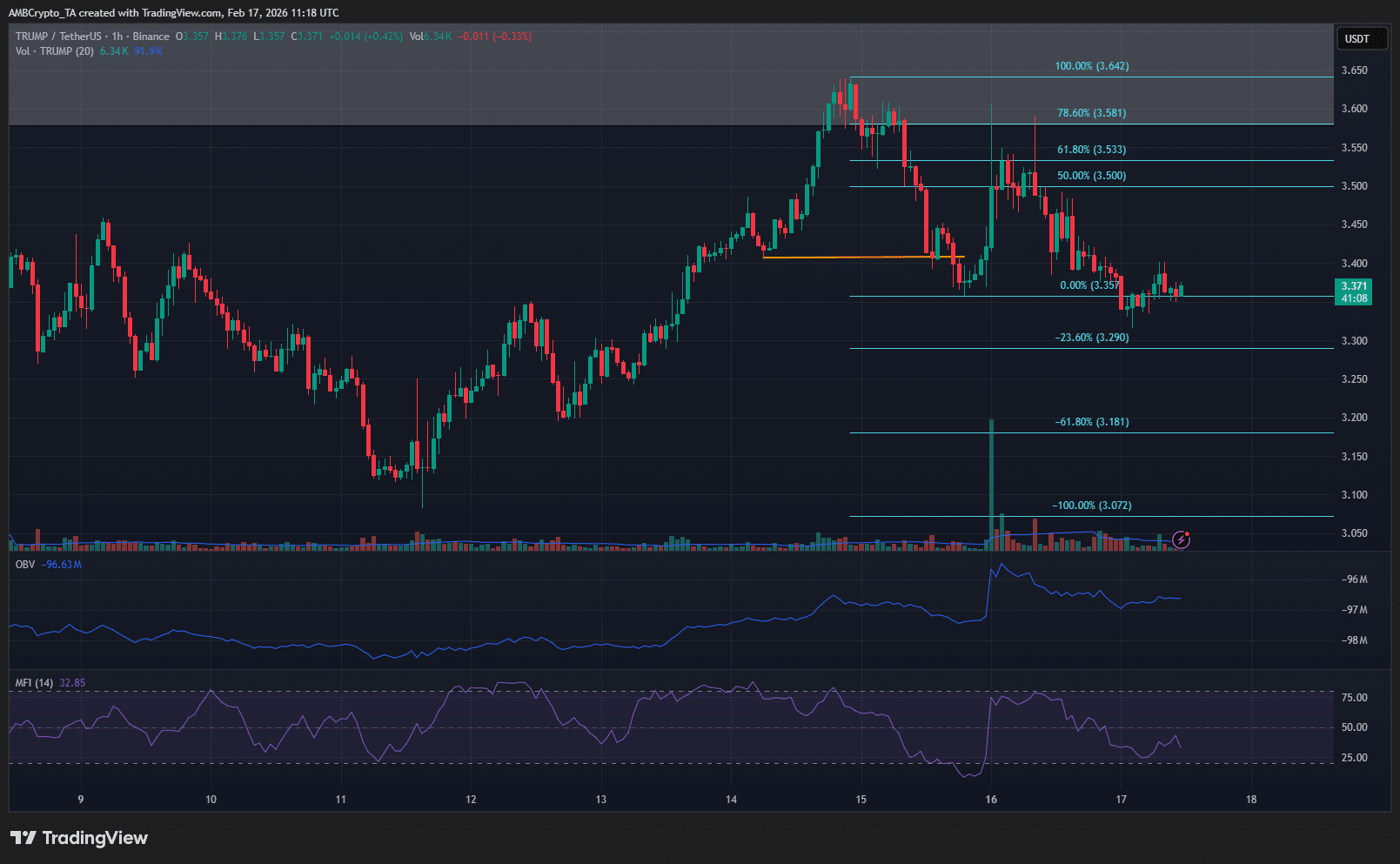

OBV rises, price falls: Why TRUMP’s ‘buy’ signals may be misleading

NZ Central Bank Policy Announcement - February 2026

Monthly Active Addresses Hit 679,000 ATH on Polymarket as Prediction Markets Face Increased Regulatory Scrutiny