Macquarie Maintains an Outperform Rating on CleanSpark, Inc. (CLSK)

CleanSpark, Inc. (NASDAQ:CLSK) is among the 11 Best Bitcoin and Blockchain Stocks to Invest in.

CleanSpark, Inc. (NASDAQ:CLSK) is among the

On February 6, Macquarie maintained an Outperform rating on CleanSpark, Inc. (NASDAQ:CLSK) and reduced its price objective from $27 to $18.

Separately, Keefe Bruyette maintained its Outperform rating on the stock and trimmed its price target from $18 to $14 on February 9, 2026. The firm pointed out concerns around ERCOT's proposed batch study, which might affect the Texas pipeline. However, the corporation remained optimistic about the Sealy location.

CleanSpark, Inc. (NASDAQ:CLSK)'s revenues in the first quarter of fiscal 2026 were $181.2 million, an 11.6% increase from $162.3 million in the same period last year. The firm reported a net loss of $378.7 million, or $1.35 per basic share, with a net income of $246.8 million, or $0.85 per basic share, in the previous year. Adjusted EBITDA was negative $295.4 million, compared to a positive $321.6 million in the prior year.

The stock was down by 16.71% YTD as of February 11, 2026.

CleanSpark, Inc. (NASDAQ:CLSK) is a Bitcoin mining technology startup. It manages data centers in College Park, Norcross, Washington, Sandersville, Dalton, and Massena.

While we acknowledge the potential of CLSK as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the

Disclosure: None.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

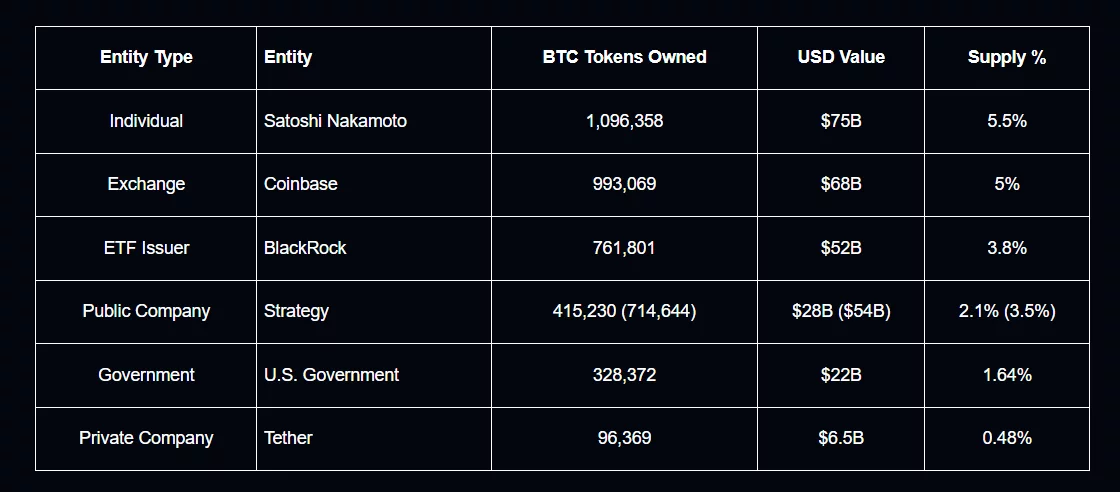

Bitcoin price prediction as Arkham data reveals who controls BTC supply