Activist Investor Nelson Peltz' Trian Fund Cut Back On This Stock In Q4, But Held Steady On GE Aerospace

Activist investor Trian Fund Management, led by Nelson Peltz, increased stakes in major industrial and healthcare names while trimming more cyclical financial positions in the fourth quarter, according to its latest quarterly 13F filing for the period ended Dec. 31, 2025.

What’s New In Trian's Q4 13F?

The firm slightly increased its stake in GE Aerospace, adding just over 500 shares to bring the total to 4.03 million shares. The incremental buy pushed the position's total market value to roughly $1.24 billion, up from $1.21 billion at the end of Q3. The move reflects continued confidence in the aerospace giant amid strong defense and commercial aviation demand.

In healthcare, GE HealthCare Technologies saw a tiny bump, with Trian adding 15 shares, bringing its total to 4,044. While the overall value of the stake is still small at about $332,000, the move signals that Trian remains interested in the long-term potential of medical imaging and diagnostics businesses.

The most dramatic change came in the financial sector. Trian slashed its Invesco position by nearly 12 million shares, reducing the holding from 14.6 million shares to just under 3 million. In dollar terms, that's a reduction of roughly $258 million, leaving the fund with a $78 million position. This massive trimming indicates a decisive pivot away from broad-based financial exposure.

Other positions, including Wendy's, Ferguson, and Solventum, were largely steady.

The Bigger Picture: Peltz, Buyouts & Activist Strategies

Trian's reported Q4 2025 portfolio value was roughly $3.98 billion with seven disclosed holdings. That reflects a concentrated lineup amid the firm’s ongoing activist and strategic pivot, including the outright $7.4 billion buyout of asset manager Janus Henderson in partnership with General Catalyst.

Peltz has signaled a potential shift toward more outright buyouts rather than traditional proxy fights. Earlier this month, the billionaire businessman noted at a WSJ event that buying companies directly can enable faster strategy implementation than negotiating with existing leadership. That is a notable flavor in markets that have seen heightened activist activity and merger momentum heading into 2026.

What’s Going On With GE Aerospace?

Aside from Janus, the fund’s next top bet is GE Aerospace.

The Ohio-based company has benefited from resilient defense and commercial aviation demand, with strong order backlogs and engine programs ramping production. Its stock is up over 55% in the past year, and closed up 3.7% at $327.08, as per data from Benzinga Pro.

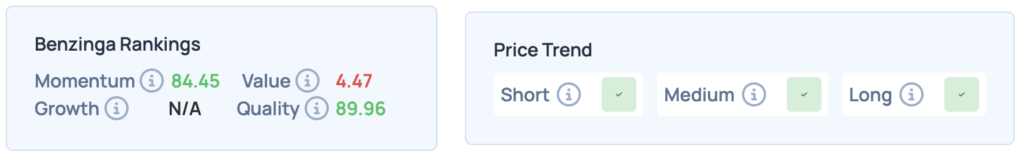

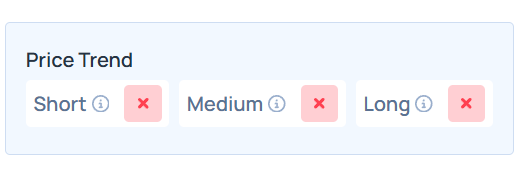

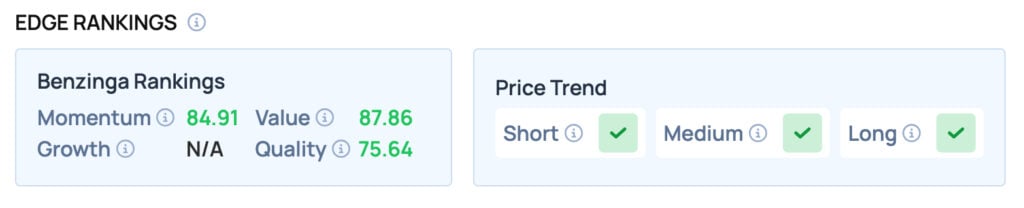

Benzinga’s Edge Rankings also indicate favourable price trends across time periods and strong Momentum and Quality rankings.

Image via Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Jim Farley Says Ford's Universal EV Platform Is Important To 'Win Against China'

Facing AI Competition Threat, Pinterest Launches "Red Alert" Project