Microsoft vs. Oracle: Which Cloud & AI Giant Has an Edge Right Now?

Microsoft MSFT and Oracle ORCL are enterprise technology titans at the forefront of cloud and artificial intelligence, each expanding AI infrastructure and embedding AI deeply across their portfolios in 2026.

Their shared cloud ambitions, premium valuations, and sharply diverging investor returns make a direct comparison especially compelling. Let's delve deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

The Case for MSFT Stock

Microsoft enters 2026 with formidable momentum across cloud and AI. In the second quarter of fiscal 2026, Microsoft Cloud revenues crossed $50 billion for the first time in a single quarter, rising 26% year over year. Azure grew 39%, with third-quarter fiscal 2026 guidance of 37-38% constant-currency growth reflecting durable enterprise demand. CEO Satya Nadella described these results as evidence of being in the "beginning phases of AI diffusion" — underscoring the long growth runway ahead.

Microsoft's AI franchise has scaled to rival its largest legacy businesses. With 15 million commercial Microsoft 365 Copilot seats, ARPU expansion is a powerful revenue lever. The February 2026 launch of Dragon Copilot for physician practices deepens AI penetration into healthcare, broadening the addressable market. January 2026 announcements of enhanced Microsoft 365 suites — embedding AI, security and endpoint management capabilities — strengthen the subscription ecosystem and support future pricing power. Microsoft also returned $12.7 billion to shareholders through dividends and buybacks during the quarter, up 32%, reflecting strong cash generation.

Commercial remaining performance obligations reached $625 billion, up 110% year over year, providing robust multi-year revenue visibility. Third-quarter fiscal 2026 revenue guidance of $80.65 billion to $81.75 billion implies 15-17% growth. Capex climbed to $37.5 billion as Microsoft scales AI data center capacity, yet operating margins remain near 47%. The company's diversified platform — spanning Azure, Microsoft 365 Copilot, Dynamics 365 and GitHub — enables layered AI monetization that competitors struggle to replicate.

The Zacks Consensus Estimate for MSFT’s fiscal 2026 earnings is pegged at $16.97 per share, marking an upward revision of 8.4% over the past 30 days. The earnings figure suggests 24.41% growth over the figure reported in fiscal 2025.

Microsoft Corporation Price and Consensus

Microsoft Corporation price-consensus-chart | Microsoft Corporation Quote

The Case for ORCL Stock

Oracle is positioning itself as a preferred AI infrastructure destination, investing heavily in Oracle Cloud Infrastructure (“OCI”) to serve hyperscale AI demand. OCI revenues grew 68% in the second quarter of fiscal 2026, with GPU-related revenues surging 177%. Oracle's multicloud database business — available across AWS, Google Cloud and Microsoft Azure — grew 817% year over year, validating its cloud-neutral strategy. A record remaining performance obligation of $523 billion, up 438% year over year, driven by commitments from Meta and NVIDIA, signals powerful forward demand.

Management maintained full-year fiscal 2026 revenue guidance of $67 billion and projected an additional $4 billion in fiscal 2027 revenues as backlog converts. In January 2026, Oracle launched its Life Sciences AI Data Platform, unifying generative AI for pharmaceutical R&D and clinical workflows. Oracle AI Database 26ai for on-premises Linux also debuted in January 2026, extending its hybrid cloud reach. Larry Ellison's January 2026 remarks reinforced Oracle's AI vision, enabling enterprises to reason securely across all private data using its integrated cloud and database stack.

However, challenges persist. Free cash flow turned negative as fiscal 2026 capex projections approached $50 billion, straining financial flexibility. Software revenues fell 3%, and a major sales force reorganization introduces near-term execution risk. Third-quarter fiscal 2026 non-GAAP EPS guidance of $1.70 to $1.74 reflects modest earnings growth despite heavy capital investment, highlighting the margin pressure in Oracle's expansion model. Backlog-to-revenue conversion remains gradual, and legacy on-premises support faces secular decline.

The Zacks Consensus Estimate for ORCL’s fiscal 2026 earnings is pegged at $7.45 per share, marking a downward revision of 0.4% over the past 30 days. The earnings figure suggests 23.55% growth over the figure reported in fiscal 2025.

Oracle Corporation Price and Consensus

Oracle Corporation price-consensus-chart | Oracle Corporation Quote

Valuation and Price Performance Comparison

Both stocks command premium valuations reflecting their AI leadership positions, though Microsoft's valuation appears more justified given its scale and profitability. Microsoft trades at a forward P/E of 21.95x, while Oracle's steeper multiple stands at a forward P/E of 19.46x.

MSFT vs. ORCL P/E Ratio

Image Source: Zacks Investment Research

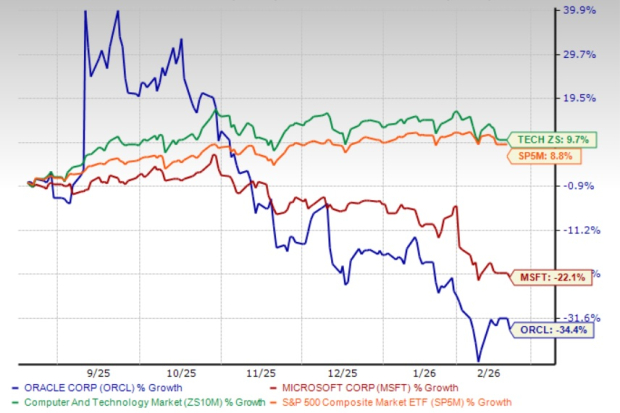

Shares of Oracle have lost 34.4% in the past six-month period, underperforming the Zacks Computer and Technology sector's appreciation of 9.7%. MSFT shares have lost 22.1% in the past six-month period outperforming Oracle.

MSFT Outperforms ORCL In 6 Months

Image Source: Zacks Investment Research

Conclusion

Microsoft holds a compelling edge over Oracle across scale, profitability, AI monetization breadth and balance sheet strength. While Oracle's OCI momentum, record RPO and multi-cloud strategy are genuine strengths, mounting capex, negative free cash flow, declining software revenues and execution risk weigh on the near-term outlook. Microsoft's diversified AI platform, growing Copilot adoption, robust 47% operating margins, and $625 billion backlog offer superior risk-adjusted upside. Investors should keep a close eye on Microsoft stock for an attractive entry point, while Oracle holders are better advised to hold or seek a more favorable entry before adding exposure. Microsoft and Oracle carry a Zacks Rank #3 (Hold) each at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin 2024 buyers steady BTC price as trader sees $52K 'next week or so'

Geopolitical Tensions Curb Crypto Optimism as Bitcoin and XRP Face Cautious Outlook

FedEx intensifies its focus on high-end e-commerce and increases delivery fees