HF Sinclair Stock Crashes 14% After CEO Takes Sudden Leave

HF Sinclair Corp. (NYSE:DINO) stock fell sharply Wednesday after the company said CEO Tim Go has voluntarily taken a leave of absence and disclosed that its audit committee is reviewing aspects of its disclosure controls.

Board Chair Franklin Myers has been appointed interim CEO and president. The refiner's shares dropped nearly 14% following the announcement.

HF Sinclair said its 2025 earnings were released on an unaudited basis but expects to file its annual report on time. The company added that its audit committee found the issues under review do not affect the financial results announced Wednesday.

On the earnings call, executives did not offer further insight into the leadership change or the ongoing disclosure review beyond what had already been made public. Myers stated that the company will share updates as more details become available.

Fourth-Quarter Earnings

The leadership update came alongside a strong fourth-quarter earnings rebound.

HF Sinclair reported adjusted net income of $221 million, or $1.20 per diluted share, compared with an adjusted net loss of $191 million, or $1.02 per diluted share, in the same period a year earlier. Adjusted earnings per share exceeded analyst estimates of 45 cents.

Net loss attributable to stockholders narrowed to $28 million, or 16 cents per diluted share, from a loss of $214 million, or $1.14 per diluted share, in the fourth quarter of 2024.

Revenue totaled $6.464 billion, down 1% year over year but above analyst expectations of $6.144 billion.

EBITDA was $235 million, while adjusted EBITDA rose to $564 million from $28 million a year earlier, reflecting improved core operations.

Segment Performance

The refining segment reported a loss before interest and taxes of $49 million, compared with a loss of $332 million in the prior-year quarter. Adjusted EBITDA improved to $403 million from a loss of $169 million, driven by higher refining margins and small refinery Renewable Identification Number waivers.

The renewables segment posted a loss of $35 million. Adjusted EBITDA improved to a loss of $6 million from a loss of $9 million a year earlier.

The marketing segment reported income of $14 million, up from $13 million in the fourth quarter of 2024. EBITDA rose to $22 million on higher margins and improved store mix. Branded fuel sales volumes increased to 337 million gallons from 333 million gallons.

Income in the lubricants and specialties segment declined to $19 million from $46 million a year earlier. EBITDA fell to $43 million due to lower sales volumes and higher operating expenses.

Midstream segment income totaled $96 million, compared with $97 million in the prior-year period. EBITDA remained steady at $114 million.

Cash Flow and Capital Allocation

Net cash from operations was $8 million in the fourth quarter.

As of Dec. 31, 2025, HF Sinclair held $978 million in cash and cash equivalents, up $178 million from a year earlier. Total debt stood at $2.769 billion.

The company returned $230 million to stockholders through dividends and share repurchases during the quarter and declared a regular quarterly dividend of 50 cents per share.

Additional Developments

HF Sinclair also formed a joint venture, Green Trail Fuels, with UPOP Holdings. The company holds a 50% non-operating stake in 30 retail locations in Colorado and New Mexico. The partnership is aimed at expanding HF Sinclair's branded presence in the Rockies and Southwest.

DINO Price Action: HF Sinclair shares were down 13.62% at $49.97 at the time of publication on Wednesday.

Image via Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

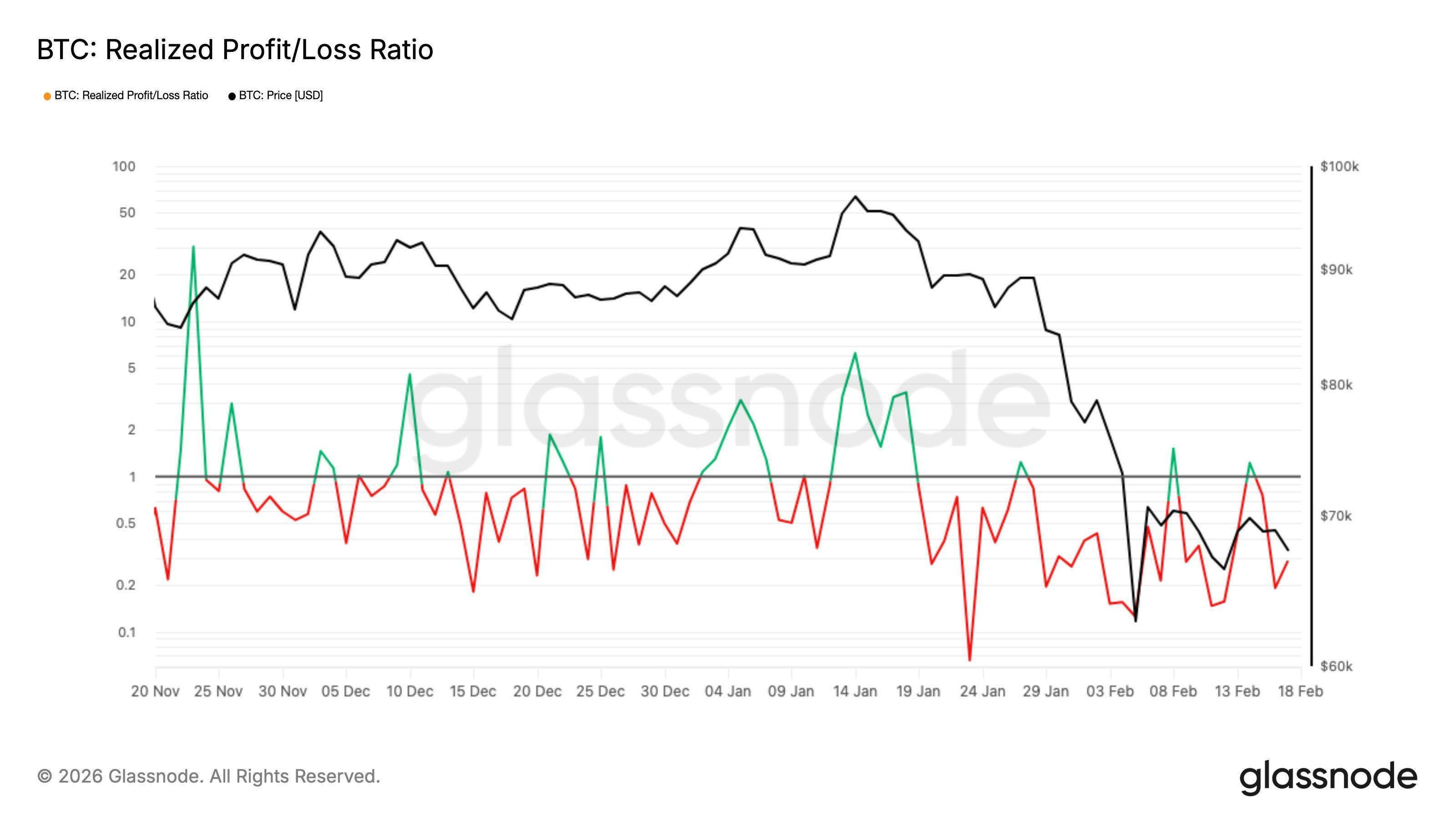

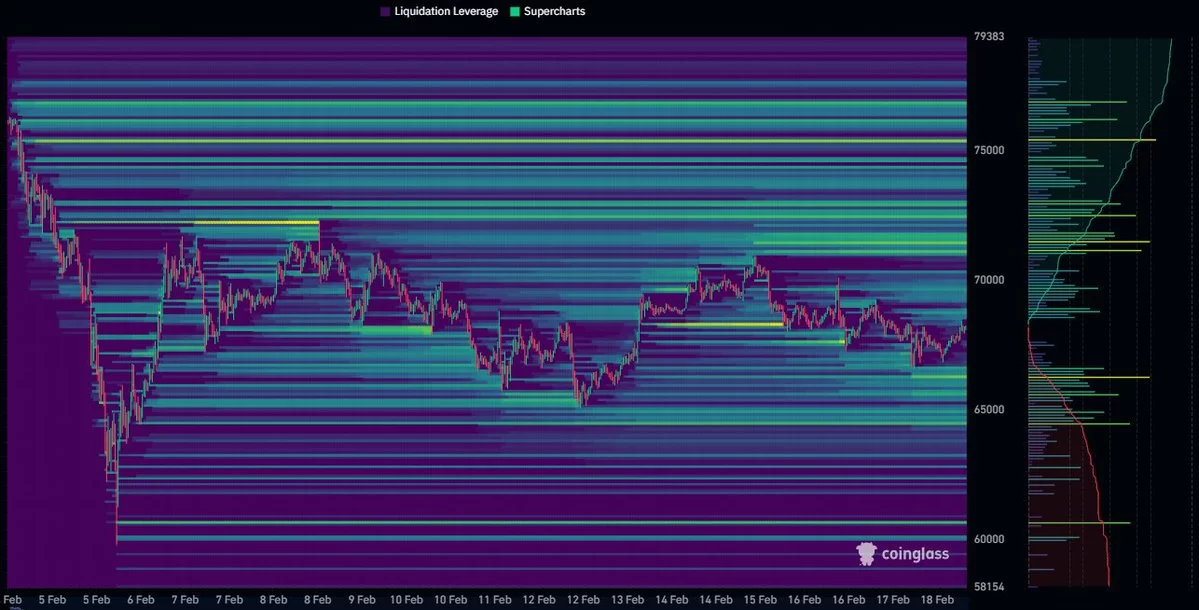

Bitcoin 2024 buyers steady BTC price as trader sees $52K 'next week or so'

Geopolitical Tensions Curb Crypto Optimism as Bitcoin and XRP Face Cautious Outlook

FedEx intensifies its focus on high-end e-commerce and increases delivery fees