Diesel benchmark rises for the fifth consecutive week

Diesel Prices Continue Upward Trend for Fifth Consecutive Week

Diesel costs, which are a key factor in calculating most fuel surcharges, have increased for the fifth week in a row. This latest rise follows earlier momentum in the futures market, although that momentum had slowed in recent days prior to Wednesday.

The U.S. Department of Energy and the Energy Information Administration reported that the average retail price for diesel climbed by 2.3 cents per gallon on Monday, reaching $3.711 per gallon. This announcement was delayed until Wednesday due to the President’s Day holiday. Over the past five weeks, diesel prices have jumped by a total of 25.2 cents per gallon, up from $3.459 per gallon before this streak of increases began.

Part of this upward pressure comes from harsh winter conditions in the Northeastern United States, where heating oil—closely related to diesel—is widely used to heat homes and buildings. Because heating oil and diesel share similar properties, their prices tend to move in tandem.

Despite these gains, price fluctuations have been relatively modest since February began, when March delivery contracts for ultra-low sulfur diesel (ULSD) became the front-month contract on the CME commodity exchange.

At the end of January, ULSD barrels for February delivery settled at $2.7356 per gallon, driven by cold weather. The March contract opened the month at $2.3598 per gallon, which remains the lowest settlement so far. The highest point this month was $2.4404 per gallon on February 11, only about 8 cents higher, highlighting the market’s relative calm.

Stability in Crude-to-Diesel Price Spread

The difference between ULSD and Brent crude prices has remained largely unchanged. After a volatile start to the year—fueled by geopolitical tensions, a weakening dollar (which tends to boost oil prices), and weather events—the market appears to have entered a phase of relative stability.

However, the International Energy Agency (IEA) released a report last week that could dampen optimism. The IEA’s latest supply and demand forecasts for 2026 indicate a significant surplus of oil supply compared to demand.

IEA Further Lowers Demand Growth Forecast

The IEA’s February update widened the expected gap between supply and demand. While the agency’s January report projected global oil demand would grow by 930,000 barrels per day in 2026, the new estimate has been reduced to 850,000 barrels per day.

Nevertheless, as veteran energy journalist John Kemp recently noted, many investors remain optimistic about oil’s future. Despite bearish forecasts, those viewing oil as an asset class are not shying away.

Kemp observed, “Investors are increasingly bullish about the outlook for oil prices as potential risks to production and tanker traffic multiply—including possible U.S. military action against Iran and tighter sanctions enforcement.” He referenced commodity exchange data showing increased net buying of oil contracts by investors.

Market Sentiment Remains Positive

These optimistic perspectives were evident at midday on Wednesday, as ULSD prices rose by 8.43 cents per gallon to $2.4749 per gallon—a 3.53% increase. If prices close at this level, it would mark the highest settlement so far this month.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aprea Therapeutics Advanced Cancer Trial Shows Promising Results, Stock Soars

Minutes of the Federal Open Market Committee, January 27–28, 2026

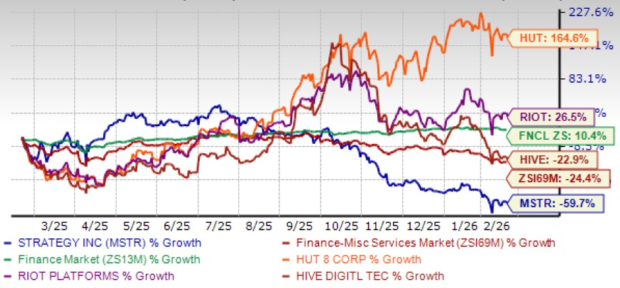

MSTR Stock Plunges 60% in a Year: Why the Dip Signals a Buying Chance

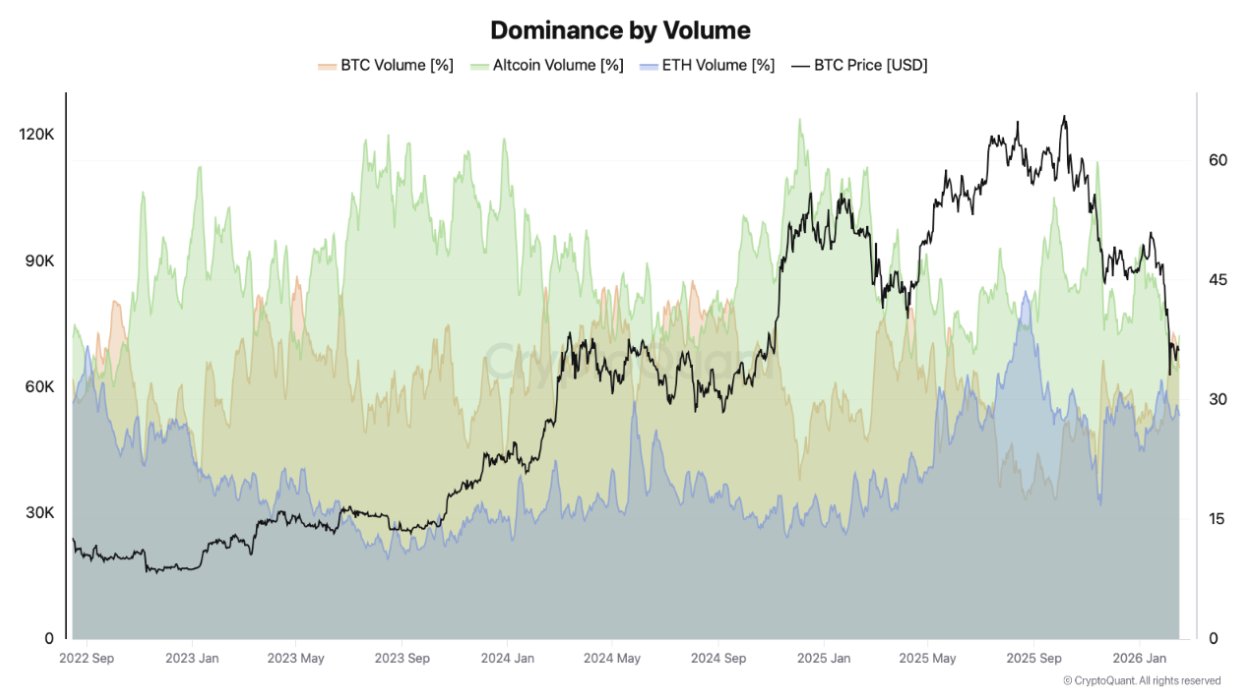

Bitcoin Dominates Crypto Trading as Altcoin Volume Drops 50%