MSTR Stock Plunges 60% in a Year: Why the Dip Signals a Buying Chance

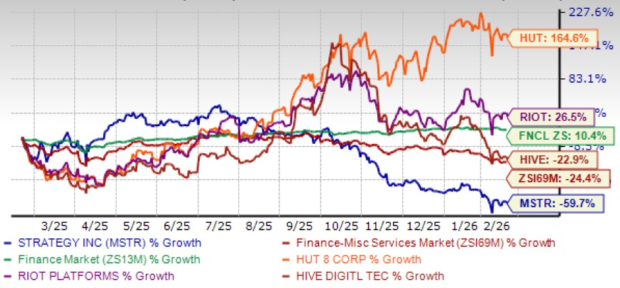

Strategy MSTR shares have plunged 59.7% in the trailing 12 months, sharply lagging the Zacks Finance sector’s appreciation of 10.4% and the Zacks Financial - Miscellaneous Services industry’s decline of 24.4%.

MSTR shares have also underperformed peers such as Hut 8 Corp. HUT, Riot Platforms RIOT and HIVE Digital Technologies Ltd. HIVE over the same time frame. Hut 8 Corp. and Riot Platforms delivered strong gains of 164.6% and 26.5%, respectively, while HIVE Digital Technologies declined 22.9% — all outperforming MSTR’s steep drop.

The bearishness is partly due to the company’s highly leveraged model, which has turned the stock into a volatile proxy for Bitcoin, making it extremely sensitive to crypto-market swings. Institutional exits, potential MSCI exclusion and rising competition from spot Bitcoin ETFs are reducing its proxy premium, while repeated equity issuance to fund additional Bitcoin purchases pressures long-term returns.

MSTR’s One-Year Price Performance

Image Source: Zacks Investment Research

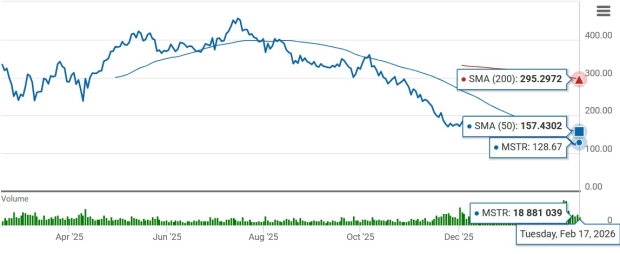

Technical indicators remain weak, with MSTR trading below both its 50-day and 200-day simple moving averages (SMAs), signaling sustained bearish momentum. This setup points to limited near-term upside potential and reflects broader investor concerns about the company’s financial stability.

MSTR Trade Below 50 and 200-day SMA

Image Source: Zacks Investment Research

Given the significant decline in Strategy shares, investors may be tempted to buy the stock. But is this the right time to buy MSTR? Let's find out.

MSTR’s Massive Bitcoin Treasury Strengthens Edge

MSTR’s massive Bitcoin treasury continues to reinforce its structural edge. As of Feb. 17, 2026, the company holds 717,131 bitcoins, representing approximately 3.4% of all BTC ever to exist, making it the largest corporate holder globally. In comparison, Riot Platforms holds 18,005 bitcoins, Hut 8 Corp. 13,696 and HIVE Digital Technologies 210 bitcoins, underscoring the sheer scale gap between MSTR and its peers.

The treasury has been built through disciplined accumulation every quarter since the third quarter of 2020, reaching a total acquisition cost of about $54 billion at an average purchase price of $76,000. This consistent strategy highlights management’s long-term conviction rather than opportunistic buying.

The scale of this reserve materially strengthens the balance sheet. The digital asset volume was $58.9 billion at the end of 2025, which proves that the strategy is designed to consistently increase Bitcoin per share over time. This dominant treasury position not only amplifies exposure to long-term Bitcoin appreciation but also underpins capital market activities, reinforcing Strategy’s position as the world’s first and largest Bitcoin Treasury Company.

MSTR’s Varied Capital Platform Supports Long-Term Growth

MSTR’s diversified capital platform has emerged as a central pillar of its long-term growth strategy. In 2025, the company raised $25.3 billion, making it the largest U.S. equity issuer for the year and accounting for approximately 8% of total U.S. equity issuance. Strategy utilized multiple instruments, including common equity, convertible debt and five preferred equity IPOs, broadening investor access across yield and risk profiles. These initiatives drove total equity, including both preferred and common, to $51.1 billion by year-end 2025, nearly doubling from $22.8 billion a year earlier.

Importantly, the capital raised has been increasingly allocated to growing Bitcoin holdings and strengthening the balance sheet. Active ATM programs across common and preferred securities continue to provide funding flexibility, with substantial capacity remaining. This multi-channel capital strategy enhances liquidity, supports disciplined treasury expansion and solidifies Strategy’s capacity to maintain sustained Bitcoin accumulation and long-term shareholder value creation.

MSTR’s Growing BTC Base Boosts Shareholder Security

MSTR’s approximately $60 billion BTC reserve provides a powerful foundation for shareholder security. With net leverage near 10% relative to BTC reserves, the company maintains a conservative capital structure well below broader market averages. Convertible debt maturities from 2027 to 2032 remain fully covered even in extreme downside cases, limiting refinancing risk.

The reserve also supports long-term dividend sustainability. With $888 million in dividends, the company estimates approximately 67 years of dividend coverage based on the current BTC reserve. Notably, management indicated that a 1.5% annual increase in Bitcoin would represent breakeven ARR, underscoring the embedded resilience within the treasury strategy.

MSTR Stock Trading at a Premium

MSTR is currently trading at a premium valuation compared to its sector, as suggested by its Value Score of F, and a forward 12-month price-to-sales (P/S) ratio of 74.18X, significantly above the sector average of 9.23X.

The premium valuation is supported by MSTR’s demonstrated ability to grow BTC per share consistently, even amid Bitcoin price volatility. A strengthened credit profile and improved balance sheet durability further support confidence in its ability to sustain treasury expansion.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

Verdict: Buy MSTR for Now

MSTR’s recent decline masks the strength of its dominant Bitcoin treasury. Disciplined capital deployment and expanding funding flexibility create a structurally advantaged model. Its strong reserve backing, conservative leverage and sustained BTC-per-share growth enhance long-term durability. For investors comfortable with volatility, the current weakness offers a strategic buying opportunity now.

MSTR currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

McDonald’s introduces high-protein menu items aimed at GLP-1 users for trial

Intuitive Machines Stock Is Leaping: What's Going On?

Reeves plans to keep the Spring Statement minimal, resisting calls to increase spending

Expert Analyst Explains That Funds in Altcoins Are Starting to Shift Back to Bitcoin!