News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | U.S. Shutdown Crisis Averted; Iran Tensions Boost Oil; Gold Rebounds Amid Microsoft Earnings Split (January 30, 2026)2Bitcoin Plunge Could Get Much Worse as Death Cross Gains Power3 Crypto Market Today Turns Red But LTH Data Signals Structural Stability

Bitcoin Derivatives See Wider Risk-Off Sentiment Amid ETF Outflows

BlockchainReporter·2026/01/31 21:00

Bitcoin drops out of the world's top 10 assets by market value, now ranking below Elon Musk's Tesla

101 finance·2026/01/31 20:36

Bitcoin falls below crucial support as Glassnode cautions about potential for deeper price declines

101 finance·2026/01/31 19:30

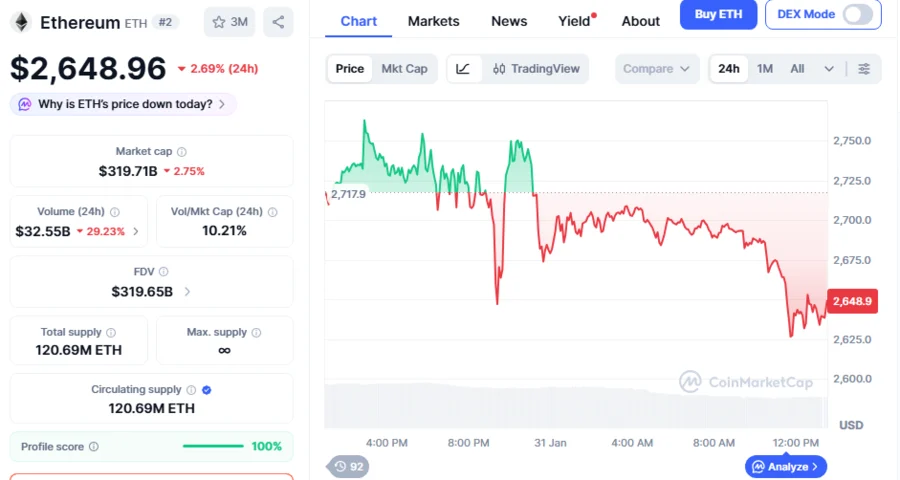

ETH Forms Head and Shoulders Pattern, Faces Potential Market Dip To $2,300: Analyst

BlockchainReporter·2026/01/31 19:15

Witness Bitcoin’s Dramatic Plunge in A Volatile Crypto Market

Cointurk·2026/01/31 19:06

Banks Could Lose $500B After Fidelity's Official Token Launch on Ethereum

Cointribune·2026/01/31 18:57

XRP Defies Market Trends: Analyzing Its Path Amid Critical Decision Point

Cointurk·2026/01/31 18:18

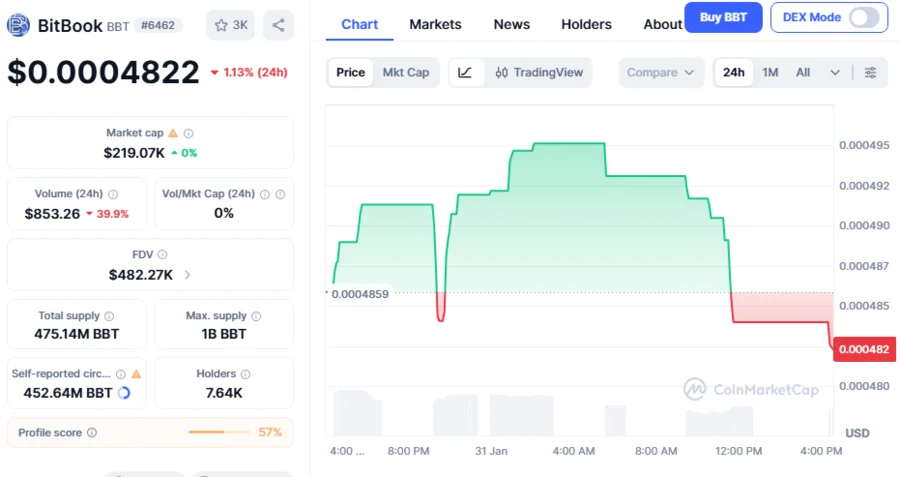

BBT Coin Consolidates Before Next 87% Pump Hidden Altcoin Gem: Analyst

BlockchainReporter·2026/01/31 18:15

Nvidia CEO pushes back against report that his company’s $100B OpenAI investment has stalled

101 finance·2026/01/31 18:15

Trump Has Pushed This Nuclear Stock to Its Highest Level in a Decade. Is Now the Right Time to Invest?

101 finance·2026/01/31 18:06

Flash

21:10

How the El Niño phenomenon can reverse the decline in cryptocurrency prices and achieve a 30% price reboundAccording to CoinWorld, despite the overall downturn in the cryptocurrency market, with bitcoin down 6.95% and altcoins down 7.98%, Layer 1 token Enso (ENSO) surged 30.8% within 24 hours, with daily trading volume soaring by 530%. After breaking below the key support level of $1.298, ENSO quickly rebounded above $1.45, demonstrating strong upward momentum. Analysts pointed out that $1.45 and $1.30 are potential buying zones, with target prices between $1.60 and $1.70, or even higher.

21:09

MicroStrategy has held Bitcoin for over 2,000 daysCoinWorld reported: According to a tweet by Michael Saylor, MicroStrategy announced that it has now held bitcoin as its primary reserve asset for 2,000 days.

20:58

Strategy Inc. (MSTR) increases its bitcoin holdings after selling shares.According to a report by Bijie Network: MicroStrategy (NASDAQ: MSTR) has increased its bitcoin holdings, spending approximately $264.1 million to purchase 2,932 bitcoins, with funds sourced from the net proceeds of a recent stock sale. The average purchase price for this acquisition was $90,061 per bitcoin, bringing the company's total bitcoin holdings to 712,647, valued at approximately $54.19 billion. Previously, an exchange reiterated its "outperform" rating on MSTR but lowered its target price, citing strong confidence in the company's long-term prospects in the cryptocurrency sector.

News