USDJPY appears poised to approach the intervention threshold again, as the Japanese Yen remains without strong upward drivers

Market Fundamentals Overview

US Dollar (USD) Update

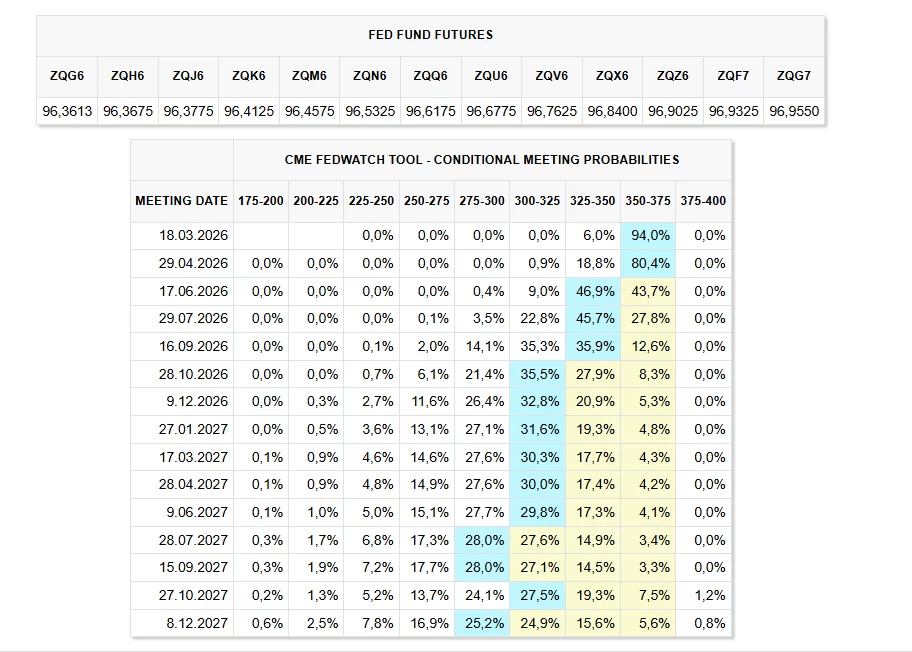

The US dollar has strengthened against most major currencies, buoyed by robust economic data from the United States and ongoing geopolitical tensions involving Iran. Despite the market still anticipating around 57 basis points of rate cuts by the end of the year, the prevailing bearish sentiment toward the dollar would require significant negative catalysts for further declines.

Currently, there is little justification for a weaker dollar, as recent US economic indicators have consistently exceeded expectations. Federal Reserve officials have also indicated that the threshold for additional rate cuts remains high, emphasizing that a clear improvement in inflation would be necessary before considering any policy easing.

Key data releases today include the preliminary US Purchasing Managers’ Index (PMI) figures and the fourth-quarter GDP report. Strong results, particularly from the PMIs, could provide additional support for the dollar. Additionally, a pending US Supreme Court ruling on Trump-era tariffs could influence the currency; a decision to overturn the tariffs may lead to dollar weakness on the back of improved global growth prospects.

Japanese Yen (JPY) Insights

Following Takaichi’s widely anticipated victory in Japan’s lower house elections, the yen experienced a notable “sell the fact” reaction, but market fundamentals remain largely unchanged. Recent data, including the latest Japanese CPI, do not indicate an urgent need for rate hikes.

The Bank of Japan recently kept interest rates unchanged, as expected, and made modest upward revisions to its growth and inflation forecasts, reflecting the impact of expansionary fiscal measures. Governor Ueda reiterated that future rate increases would depend on the economic outlook, with April’s price trends being a key consideration for the next potential hike. Markets are currently expecting the next rate increase in June, with a total of 51 basis points of tightening projected by year-end, equivalent to two hikes.

USDJPY Technical Analysis – Daily Chart

Examining the daily timeframe, USDJPY has continued its upward movement after rebounding near January’s lows and a significant trendline. A descending triangle pattern appears to be forming, with the neckline situated around the 152.00 level. Sellers may look to capitalize on the downward trendline, setting stops just above it, aiming for a move back toward the 152.00 support. Conversely, buyers will be watching for a breakout above resistance, which could open the door for a rally toward the 159.00 area.

USDJPY Technical Analysis – 4-Hour Chart

On the 4-hour timeframe, the pair broke out of a consolidation range midweek, triggering increased buying interest and reinforcing the bullish trend. Unless significant fundamental shifts occur, buyers are likely to maintain control until the price approaches the descending trendline.

USDJPY Technical Analysis – 1-Hour Chart

The 1-hour chart highlights a support zone near 154.60, which aligns with an upward trendline, offering a favorable risk-reward setup for buyers seeking a breakout above the descending trendline. Sellers, meanwhile, may target a move below this support to extend losses toward the 153.70 level. The red lines on the chart indicate today’s average daily range.

Key Events Ahead

To wrap up the week, today’s agenda features the US fourth-quarter GDP, December’s PCE price index, Flash PMIs, and a possible US Supreme Court decision regarding Trump’s tariffs. For a full schedule, see the economic calendar.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Should Janus Henderson Small Cap Growth Alpha ETF (JSML) Be on Your Investing Radar?

Markets Brace for Key Fed Inflation Report and Supreme Court Tariff Decision

Balchem Corporation Reports Fourth Quarter and Full Year 2025 Financial Results